Portfolio

Our Recent work.

Meet The Team

Vishal Harishchandra

Founder & CEO

Anthony Garcia

Business Development

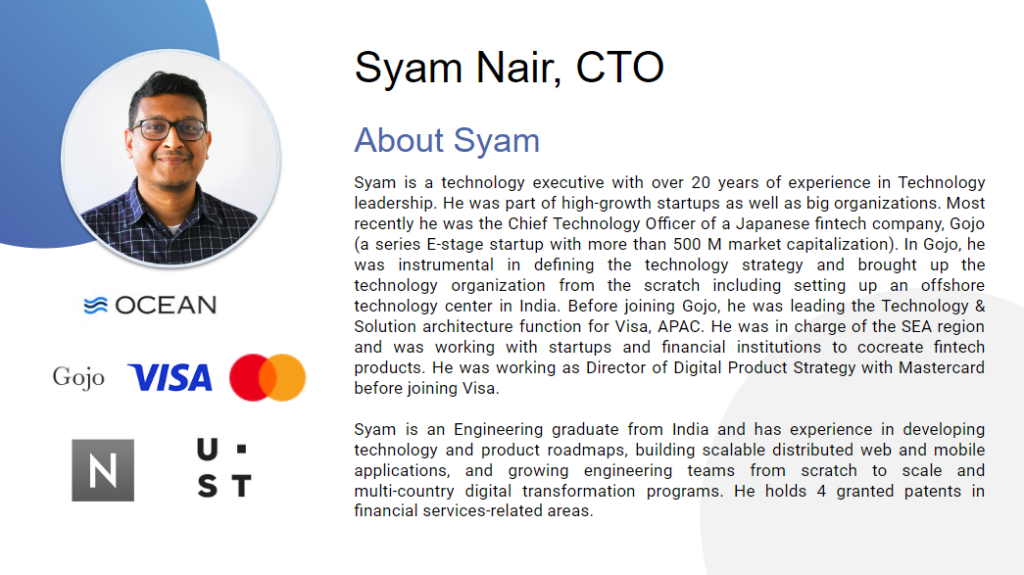

Syam Nair

CTO

Campbell Reyburn

Business Development

Mitchell Lock

CMO

Orgilchimeg Ishdorj

Admin

Stefan Rothlin

Founder & CEO

Advisory Board

Michael Robert Blakey

Advisor

Michael Robert Blakey

Advisor

Jean Claude Donato

Advisor

Guillaume Leger

Advisor

Sanjay Babur

Advisor

Newsletters

2024 Newsletters

Transforming the global supply chain for SME’s & delivering exceptional returns for shareholders.

A Message from the CEO

Dear Shareholders, Investors & friends,

As we reflect on the past year, a single word encapsulates our journey: transformation. We’ve not only defied expectations, but surpassed them, positioning Ocean for an incredible future.

Building a Financial Powerhouse:

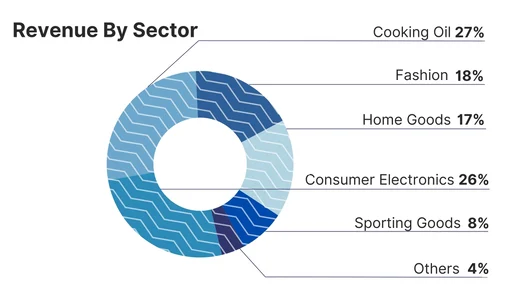

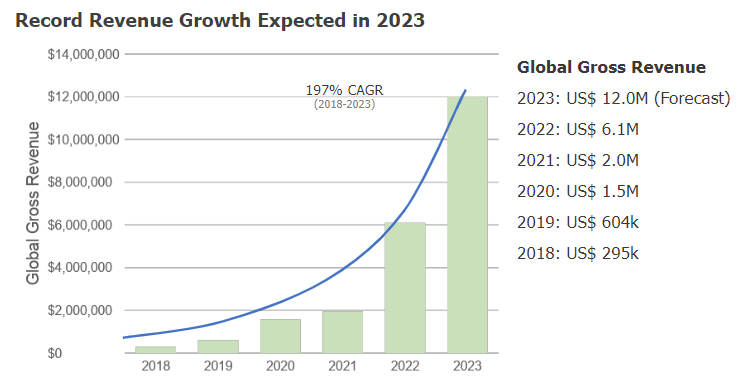

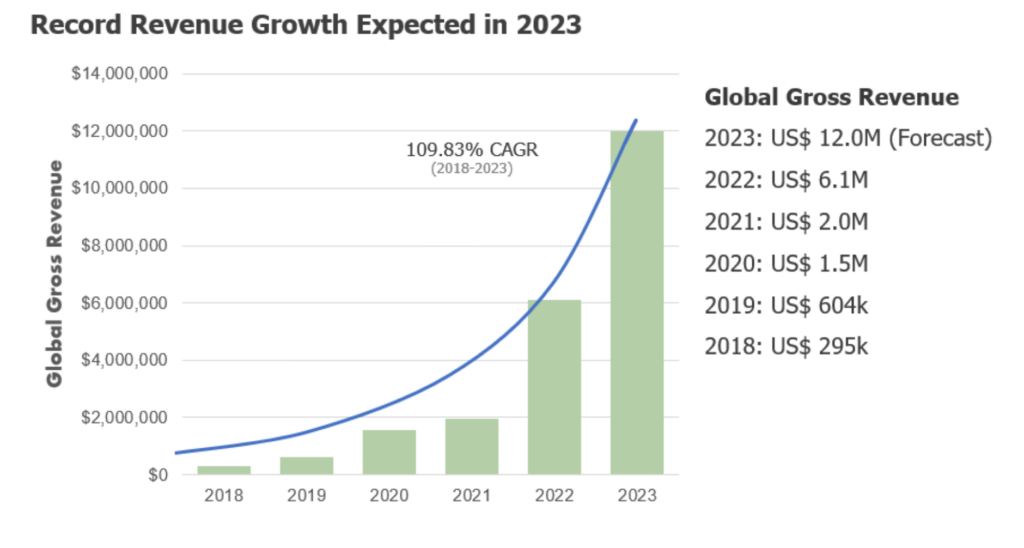

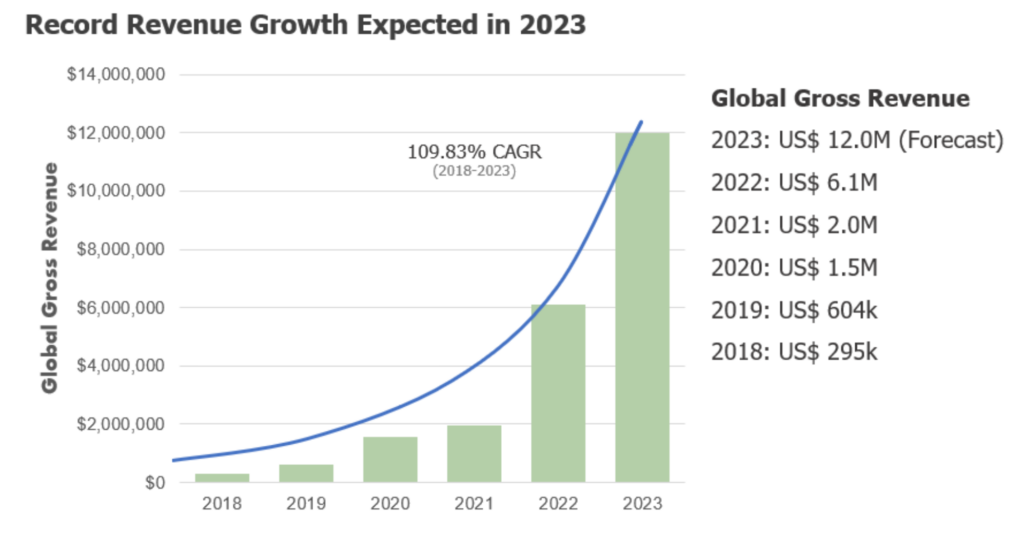

- Explosive Growth: We secured an impressive US$12 million ARR, a 1200% increase from our seed round.

- Unparalleled Efficiency: With a lean team of 10, we boast a default rate under 1%, demonstrating the exceptional quality of our operations.

- Partnering with Industry Leaders: Recent contracts with giants like Allianz and Coface solidify our position in supply chain finance.

Unveiling the Power of AI to help SME’s:

It’s not just a buzz word for us. We’ve integrated cutting-edge AI and Large Language Models (LLMs) into our Ocean Fintech Platform. This translates to:

- Faster approvals with SLM’s

- Better risk management with AI underwriting

- Smooth shipment processing

- Increase in efficiency

- Seamless user experience for clients

The Road to Liquidity:

The future is bright. We’re gearing up for:

- Series A funding round of US$5-15 million. This capital injection will fuel further platform development and global expansion.

- Targeted US$100 million ARR by 2026, paving the way for an IPO in 2026/2027 with a projected market cap of US$600 million.

Our Vision: A Billion-Dollar Future

We envision:

- US$1 billion ARR by 2030

- Market Cap of US$5 billion

Conclusion:

As we conclude another remarkable year, I want to express my deepest gratitude to all our shareholders and advisors for your unwavering support and trust in our vision.

Your belief in our mission fuels our drive to innovate, grow, and succeed. Together, we have navigated challenges, celebrated milestones, and set the stage for an even brighter future.

I am excited about the opportunities that lie ahead and confident that, with your continued support, we will achieve even greater heights.

Thank you for being an integral part of our journey.

Sincerely,

Vishal Harishchandra

Chairman & CEO

Valkin Limited DBA OCEAN

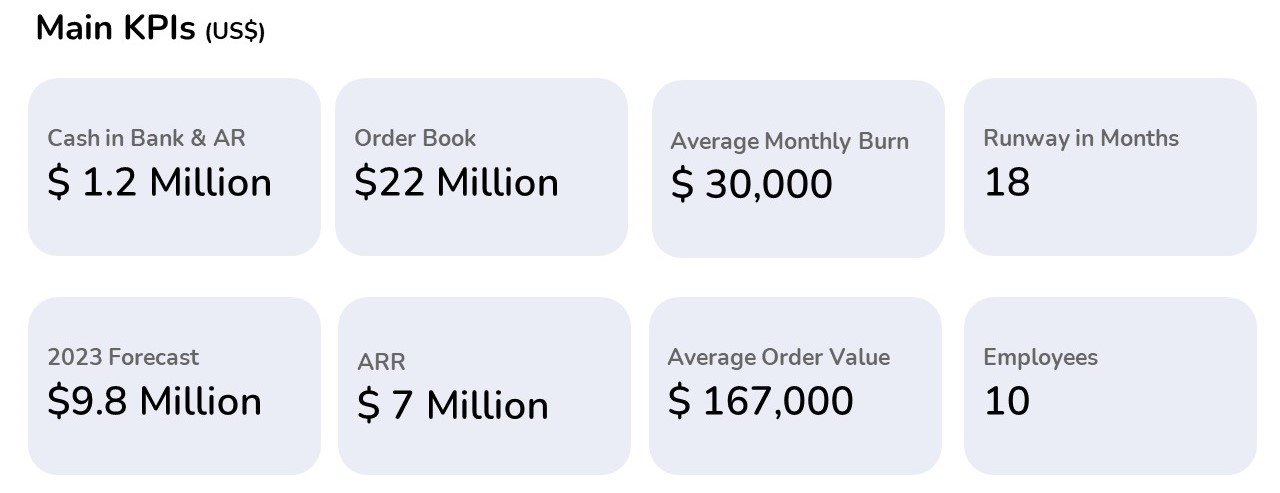

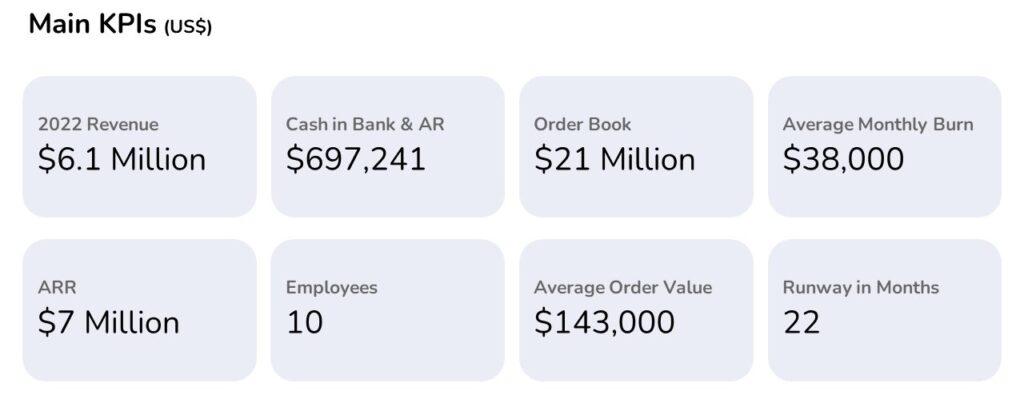

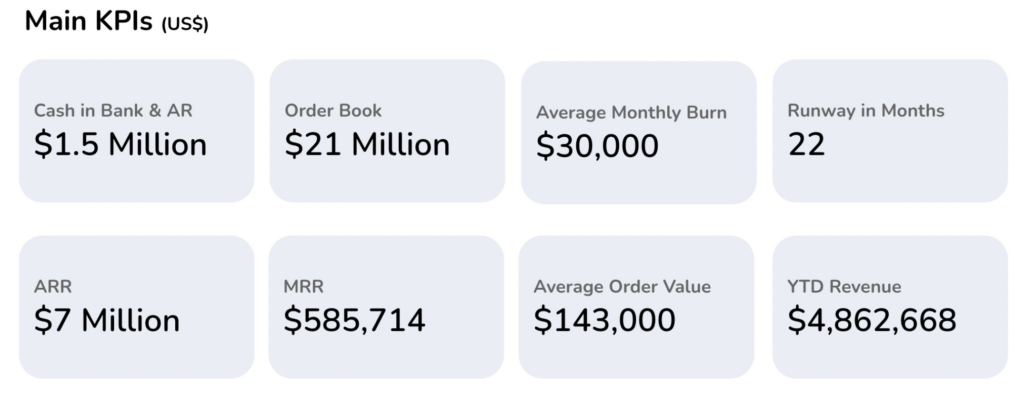

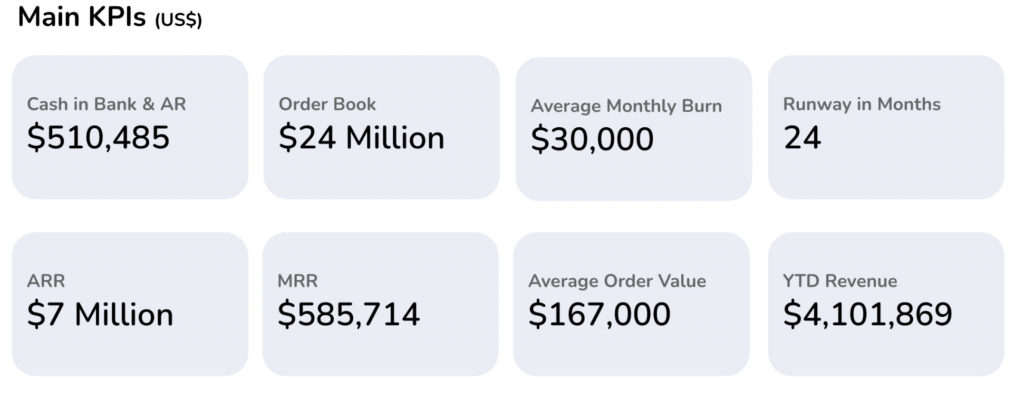

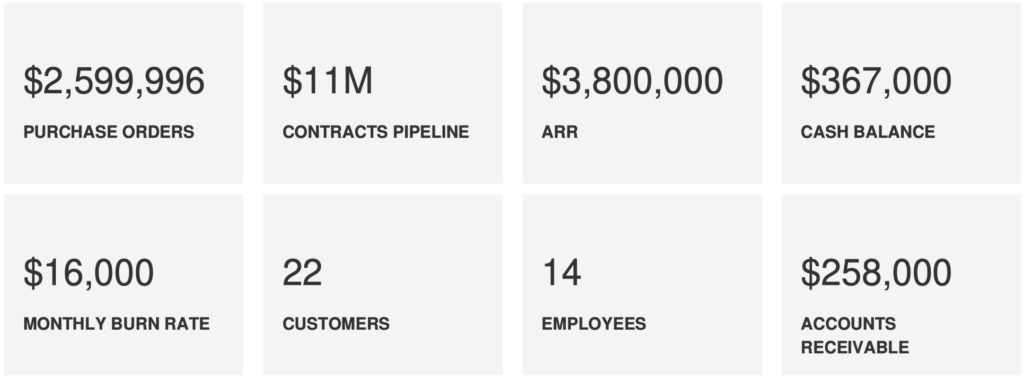

Main KPI’s

US$2.4 Million

Cash & Receivables

US$12 Million

ARR

US$176,000

AOV

US$38,000

Monthly Burn

US$7 Million

2023 Annual Revenue

87%

YOY Growth

Series A coming soon…..

Please sign up today to reserve space in our Series A. We look forward to sharing this extraordinary journey with you.

Investor Resources:

For equity or debt investments, please contact:

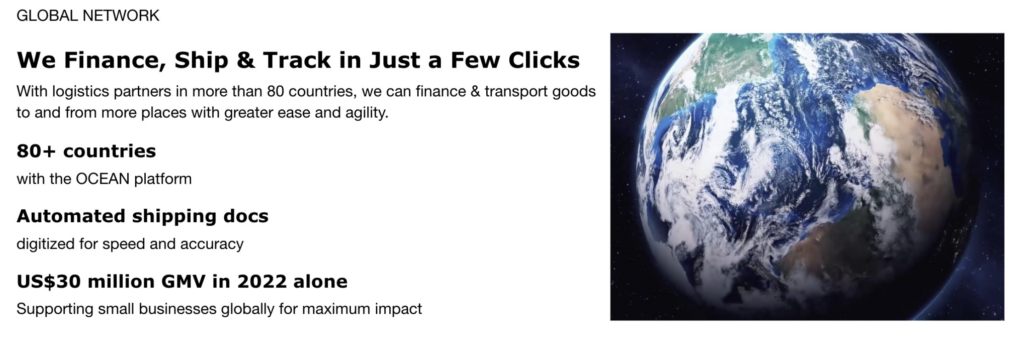

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Dear Ocean Friends,

We hope this update finds you well.

• ARR

OCEAN Fintech Crosses US$10 Million ARR

• Bonds in New York

We are thrilled to announce Ocean Fintech will be working private credit platform Percent to give accredited investors

access to US$10 million in investment grade receivables with upto 12-14% annual returns.

• New Contract

Ocean signs contract with Dailypack, a top 3PL company in Leusden, Netherlands.

• New Technology

We have just implemented AI based underwriting, document management, a seamless Cross Border Workflow

Engine, and real-time transaction monitoring through DeepScan and Trade Analysis modules.

• New Customer

We’re excited to finance GLO Science. GLO Science is an innovative teeth whitening company using gentle heat and

light technology (GLO) for faster, professional-grade results with minimal sensitivity.

With warmest regards,

The Ocean Team

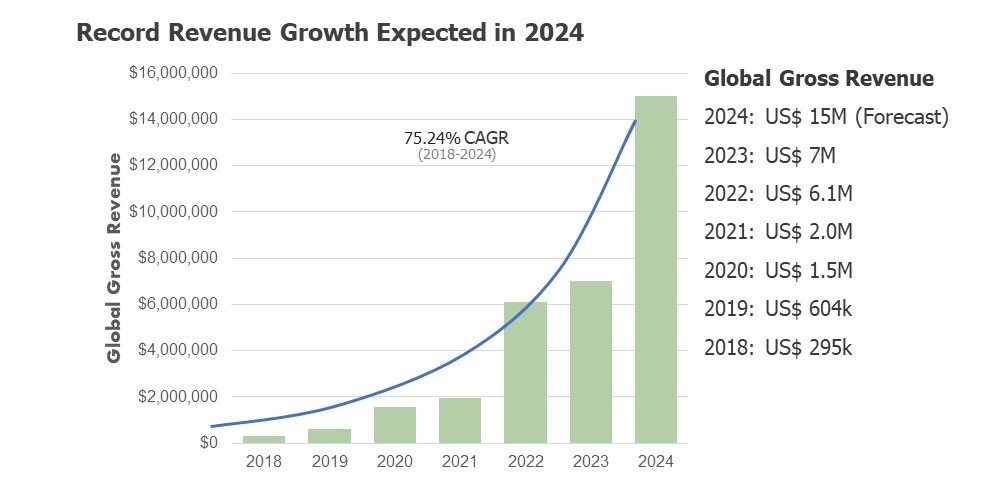

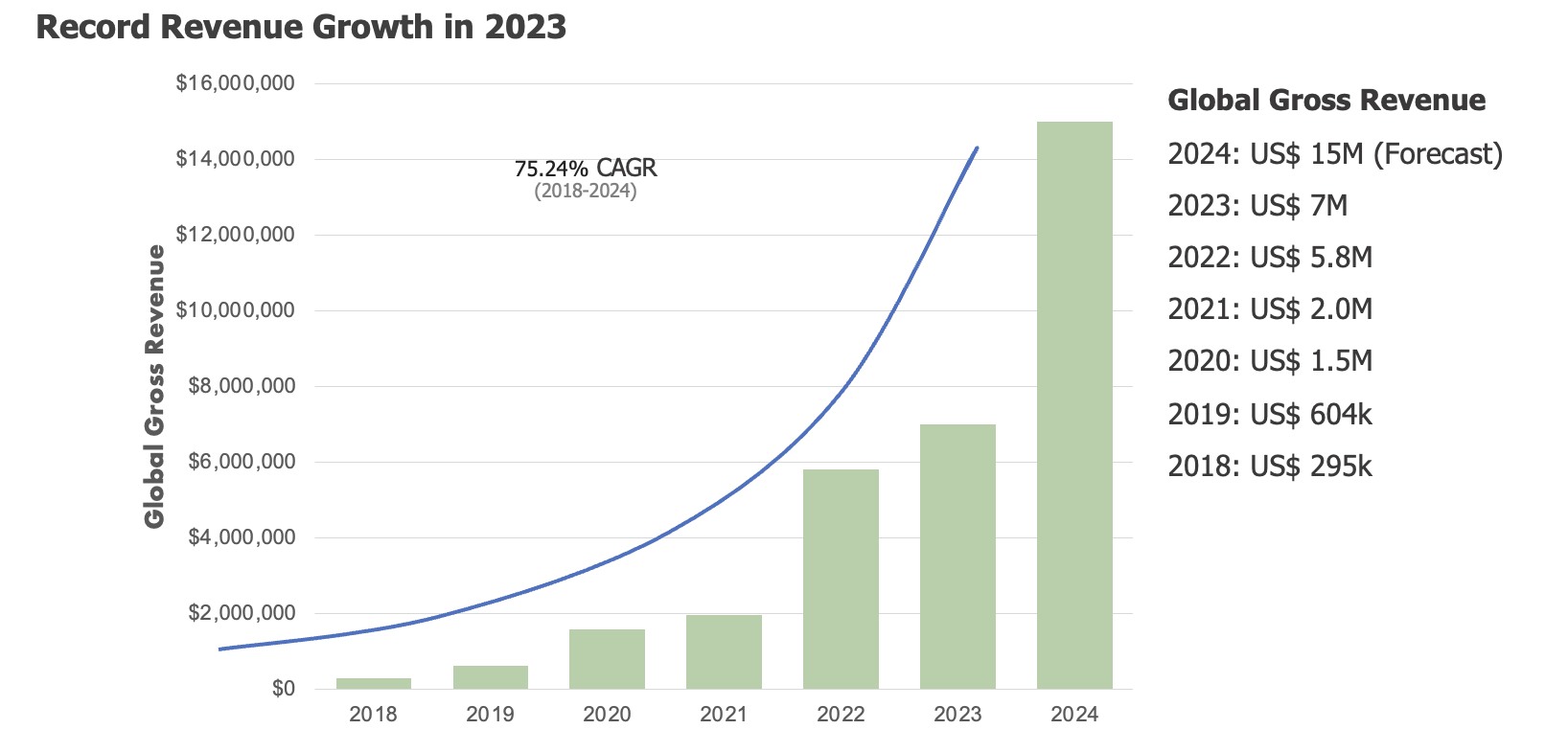

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

OPERATION SPOTLIGHT

Ocean Fintech signs a new agreement with leading private credit platform Percent. This strategic move empowers investors with seamless access to investment-grade assets, previously reserved for institutional players.

Ocean will be issuing upto US$10 million in short term credit insured receivable notes with returns of 12-14%p.a.

Investors can now tap into a high-performing asset class with greater ease and efficiency. This integration simplifies the process, eliminates unnecessary hurdles, and opens doors to attractive returns.

We are delighted a new contract with Dailypack, a distinguished 3PL company headquartered in the Netherlands.

Through this joint effort, we bolster our logistics capabilities, spanning warehousing, order fulfillment, transportation, distribution, and customs clearance and our Stock & Release program across Europe.

We see growing to a potential stand alone US$100 million distribution program within 5 years in Europe and UK.

EVENTS

We hosted a highly anticipated Family Office & VC Lunch focused on our Fintech Portfolio company, Ocean Fintech.

The event provided attendees with an exclusive opportunity for socialising, networking, and engaging in discussions about Ocean Fintech’s upcoming Series A, Pre-IPO, and IPO plans.

Moreover, participants explored impact investment strategies, emphasising Ocean’s commitment to supporting SMEs, minority founders, women-owned businesses, and circular economy enterprises.

We plan to have many more great conversations in London, New York, Hong Kong and Sydney in the next few months.

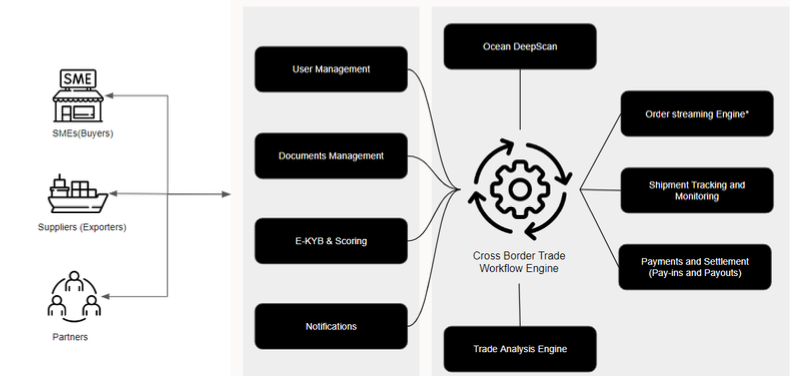

TECHNOLOGY SPOTLIGHT

Ocean platform enables seamless cross border trade using advanced AI and Machine learning

• AI based document management – Today Cross border trade is heavily paper based and extremely complex in managing documents. We have our AI based document management module which will classify, extract, digitise and manage documents.

• Cross Border Workflow Engine – Trade is super complex and multiple parties involved in a single step. We have developed a complex workflow engine fine tuned for cross border trade transactions so that all parties are

updated/informed/notified at right time.

• DeepScan and Trade Analysis Engine – These two modules are our machine learning models to analyse trade transactions. We evaluate, analyse and ingest vast amount of trade data.Using these two modules, we monitor trade transactions viability, risk and fraud on real time using these machine learning models deployed.

• Order streaming Engine * (work is going on) – We plan to stream orders from Shopify and other prominent e-com platforms where our customers sell products. This is mostly used for stock and release product but also create an alternate data input for DeepScan algorithm.

CUSTOMER SPOTLIGHT

Ocean Fintech welcomes GLO Science, a pioneer in teeth whitening technology, to our growing family!

GLO Science harnesses the power of Guided Light Optics (GLO), combining gentle heat and light to activate their whitening gel for faster, more effective results – all with minimal sensitivity.

Dentist-founded and patent-protected, GLO Science delivers professional-grade smiles from the comfort of home. Join us in celebrating this partnership and illuminating the future of dental care!

HOW CAN YOU HELP?

We’re actively hiring so please share these open positions with your network:

• Chief Operating officer with experience in Fintech or Logistics tech

• Sales executive (Corporate Finance)

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

We are grateful for your continued support and belief in our mission to make international trade credit more accessible to

everyone. We’ll be sure to keep you updated on our progress.

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN

https://www.thisisocean.com

https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

2023 Newsletters

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Dear Ocean Friends,

We hope this update finds you well.

• OCEAN Fintech reinforces its credit risk model by doubling its credit insurance policy with global leader Allianz, offering clients even more access to trade credit. Through the Allianz policy we have access to 85 million+ companies monitored in their proprietary risk database.

• Ocean kicks off beta testing for its cutting-edge DeepScan AI technology to enhance security and trust in the cross border trade experience.

• We’re excited to share our investment in THDR Group Pty Ltd. They are set to redefine the tailoring experience, focusing on enhancing customer satisfaction and fostering business growth.

With warmest regards, The Ocean Team

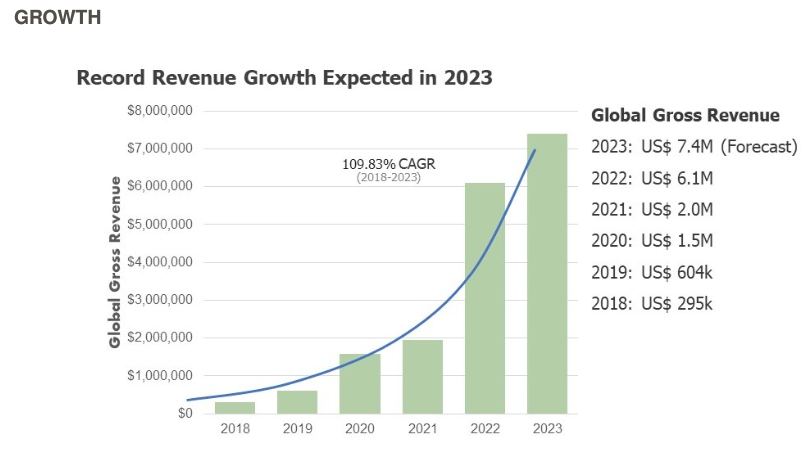

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

OPERATION SPOTLIGHT

Ocean Fintech has doubled its credit insurance policy with Allianz to meet the growing demand for financing from its clients. This expansion of the contract will provide OCEAN Fintech with access more capital pools and trade credit to help scale the business.

Allianz is a global leader in credit insurance with 85 million+ companies monitored in their proprietary risk database.

CONFERENCE

Over the past few months, we have had the honor of participating in a series of prestigious business and trade events:

• Caproasia Amara Sanctuary

• Business and Philanthropy Forum 2023 • ASX IPO AND EXITS PANEL

• Picus Capital Tech Mixer

• Ocean Fintech- Idea to IPO Discussion

These exclusive gatherings have provided our team with an exceptional platform to connect with industry leaders, stay at the forefront of private equity and venture capital trends, and gain profound insights into these dynamic sectors.

Our goal of engaging in these events is to expand our global network and nurture meaningful relationships.

TECHNOLOGY SPOTLIGHT / OCEAN’S CORE COMPONENTS

OCEAN has started beta testing its Deepscan platform.

Ocean’s platform leverages AI & Machine learning, and cloud technologies to provide the best-in-class cross-border trade experience to our customers.

Buyers and suppliers can onboard the platform and submit invoices to initiate the trade transaction, while the rest of the complexities will be taken care of by our platform.

To ensure a seamless and trusted cross-border trade experience, Ocean is developing a machine-learning model called DeepScan. DeepScan has been trained using unstructured and structured cross-border trade data from both first-party and third-party sources, safeguarding buyers and exporters from fraud.

The first version of DeepScan is embedded in the Ocean platform, with planned iterations for the next year.

CUSTOMER SPOTLIGHT / THDR GROUP PTY LTD

We’re thrilled to share some exciting news that’s making waves at Ocean Fintech!

Join us in extending a warm welcome to our newest trading partner, THDR Group Pty Ltd.

Ready-to-wear or “fast fashion” produces a significant amount of waste, a large portion of which ends up in landfill. Creating high-quality garments that are made to order and made to last is one of the key ways we help make the planet a better, more sustainable place to live.

Their garments avoid overproduction wastefulness. They aim for natural fibres during production, cut on demand and design to be worn and re-worn.

At Ocean, we understand that each financial voyage is unique. That’s why we’re dedicated to tailoring our services to meet the specific needs of THDR Group and help them grow their business.

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

• Chief Marketing Officer

• Chief Operating officer with experience in Fintech or Logistics tech • Sales executive (Corporate Finance)

As we plan to open our Series A in Q2/Q3 later this year – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

We are grateful for your continued support and belief in our mission to make international trade credit more accessible to everyone. We’ll be sure to keep you updated on our progress.

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Dear Ocean Friends,

Hope you are well. We are super excited to share the big news!

- New Contract

We’re thrilled to share we have signed a new commercial agreement with Olea, which is a JV between Standard Chartered bank and Linklogis. This will allow us to fulfil more purchase orders and create groundbreaking financial solutions for our SME customers. - Additional Revenue

We just booked another US$ 1,200,000 in purchase orders with the total pipeline going up to US$22 million. - New Investor & Advisor

We are thrilled to welcome Mr Shiva to our cap table and family. He is the Ex CEO APAC for Lloyds bank and has deep experience in supply chains. - Impact Investing

We are proud to support HereWeFlo’s supply chain. The company is founded by two amazing women entrepreneurs. It is a remarkable brand that embodies sustainability, organic practices, and vegan period care.

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

CONFERENCE

Over the past few months, we have had the privilege of participating in a series of esteemed business and trade events:

• Private Wealth Asia in Singapore

• SuperReturns in Berlin

• Prestel & Partners Family Office Forum in London

• NACFB in Birmingham

• The World Family Office Forum in Montreux

• The European Single Family Office Symposium in Lausanne

These exclusive events have served as an invaluable platform for our team to forge connections with industry luminaries, remain at the forefront of private equity and venture capital trends, and gain profound insights into these dynamic industries.

By immersing ourselves in these environments, we have not only enhanced our ability to cater to the unique needs of our clients, but also expanded our global network and fostered meaningful business relationships.

PARTNERSHIP SPOTLIGHT

Olea is a fully-digitized trade finance origination and distribution platform.

Leveraging the capabilities of Standard Chartered and Linklogis, Olea brings together unparalleled expertise in international trade and risk management through their leading technology platform.

At Ocean Fintech, we’ve always been committed to pioneering solutions that redefine financial technology. Our vision aligns perfectly with our dedication to innovation, customer-centric solutions, and driving positive change in the world of finance for SME’s.

CUSTOMER SPOTLIGHT

We have just invested in HereWeFlo, an inspiring addition to the Ocean family—a brand that embodies sustainability, organic practices, and a commitment to vegan period care.

HereWeFlo offer a diverse range of offerings, including tampons, pads, liners, and period underwear. Their products are designed with an unwavering dedication to both people and the planet, crafted using premium plant-based ingredients to minimise their environmental footprint.

HereWeFlo also champions a greater cause by donating 5% of its profits to charities dedicated to supporting women and girls by fighting period poverty across the globe.

We take immense pride in collaborating with HereWeFlo and support in championing their mission to revolutionise period care by making it more sustainable, affordable, and accessible for all.

HOW CAN WE WORK TOGETHER?

We are actively deploying capital so if you have any portfolio companies that are looking for growth capital and open to debt that meet the criteria below, we would love to have a chat.

Eligibility Criteria

• Annual Revenue above US$1 million

• Deal in Hardware (Consumer goods, Sportwear, household goods, Medical devices, etc)

• Located in Developed Markets (US, UK, EU, AU, etc)

We are also actively hiring so please share these open positions with your network:

• Chief Marketing Officer

• Chief Operating officer with experience in Fintech or Logistics tech

• Sales executive (Corporate Finance)

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

We are grateful for your continued support and belief in our mission to make international trade credit more accessible to everyone. We’ll be sure to keep you updated on our progress.

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello OCEAN Friends,

We hope this update finds you well. We’re excited to share some exciting updates about our company and the progress we’ve made.

- Our team has grown significantly in the past few months. We have hired 5 new engineers and 2 business development professionals. With this expansion, we are well on our way to meet our targets for Q2.

- We have moved to Amazon Web Services and have a new website www.thisisocean.com

- Our user base has increased by 35% in the past month, and we are seeing consistent user engagement. We continue

to gather valuable feedback, which we use to improve our product. - We have recently launched a new tech feature that allows our users to place orders directly in our platform, further

strengthening the relationship between our users and the platform.

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

CONFERENCES

We were thrilled to announce that OCEAN had attended a series of prestigious business events in March 2023, including The 0100 Conference Europe, The Asian Family Office and Investment Forum, and The Private Credits APAC Forum in Singapore.

These events provided an excellent opportunity for OCEAN to network with industry experts, stay up-to-date with the latest trends, and gain valuable insights into private equity and venture capital. Also allowed us to connect with like-minded professionals from all over the world, expanding its business network, and fostering new business relationships.

TECHNOLOGY SPOTLIGHT

We are ready to announce the launch of our new website, https://www.thisisocean.com. Our team has been working hard to create an online platform that offers a seamless experience for our clients who need cross border inventory finance.

At Ocean, we believe that cross-border trade should be accessible to everyone, regardless of the challenges that may arise due to lack of financing. We provide a unique solution to our clients, allowing them to optimize their cash flow while accessing new markets and expanding their businesses.

INDUSTRY NEWS

Supply chain-focused startups have been successful in attracting investors despite a contraction in funding across most other startup sectors. In 2022 alone, these companies have secured over $7 billion in funding from seed through growth-stage rounds globally, which was on par with 2021’s record-setting levels. This is a testament to the potential of these startups to address the growing demand for efficient supply chain management in today’s global marketplace.

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

- Sales executive (Corporate Finance)

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

We are grateful for your continued support and belief in our mission to make international trade credit more accessible to everyone. We’ll be sure to keep you updated on our progress.

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello OCEAN Friends,

- We’re pleased to announce a brand new additional credit insurance contract for our New York Office with Coface. This will allow us to take on another US$3-6million in new contracts with faster underwriting in the US.

- We welcome new addition to our cap table, Michael Blakey, Managing Partner and co-founder of Singapore-based venture capital firm Cocoon Capital.

- We’re pleased to announce a new customer Factor52, a digital wholesaler of consumer electronics. Our Inventory Finance solution leverages cutting-edge technology to boost their imports into the Netherlands and cater to the diverse European customer base of Factor52.

- Our Core platform is undergoing a huge upgrade to be complete by Mar 2023 and will be fully operational by Q3. This will have our Open Credit dashboard implementation with end to end cross border payments integrated.

GROWTH

CUSTOMER SPOTLIGHT

Factor52 combines traditional distribution and reselling with cutting-edge technology to help brands increase sales while preserving their unique identities and profit margins.

With a global reach and an end-to-end approach to commerce management, Factor52 specializes in working with high-quality brands across a wide range of products, including household appliances, electric heaters, consumer electronics, batteries, 3D printers, kitchenware, furniture and more.

Through this partnership, Ocean will now be able to offer our Inventory Finance solution to Factor52’s diverse customer base, helping them to streamline their operations and achieve their business goals.

We look forward to working with Factor52 and helping our customers achieve greater success in the e-commerce space.

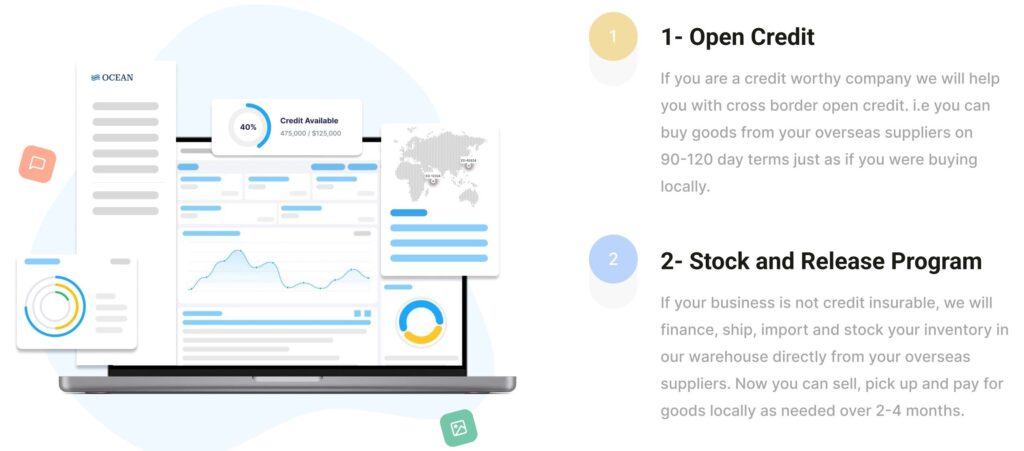

LET’S MAKE A TRADE

OCEAN is committed to helping businesses around the world succeed. Our two main supply chain programs include Open Credit & Stock and Release.

CUTTING EDGE DIGITAL SUPPLY CHAINS

Digital supply chains can help companies create full transparency into every stage of the supply chain, streamline business processes, and bring clarity to the finance function. In 2016, analysts at McKinsey articulated the idea of a next-generation digital supply chain, called Supply Chain 4.0. Digital twins are used tactically to visualize physical supply chains and provide diagnostic, analytical and feedback capabilities.

They can be used to pivot, reroute or reallocate finances in the supply chain. Data quality cannot be overstated, nor can the need for cross-checking, comparing and aggregating data from a variety of reliable sources. Advanced analytics interprets intelligence from all types of data sets, both structural and dynamic. Modern-day technological tools are essential for survival and growth. They help businesses maintain operations, even grow, in the face of adversity.

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

Thanks to all for your support and guidance on this journey!

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

2022 Newsletters

Let’s Make a Trade Enabling Global Trade for SME’s

Dear OCEAN Friends,

We hope this newsletter finds you well as we kick off the new year. We are thrilled to share with you the exciting developments and progress that OCEAN has made over the past year.

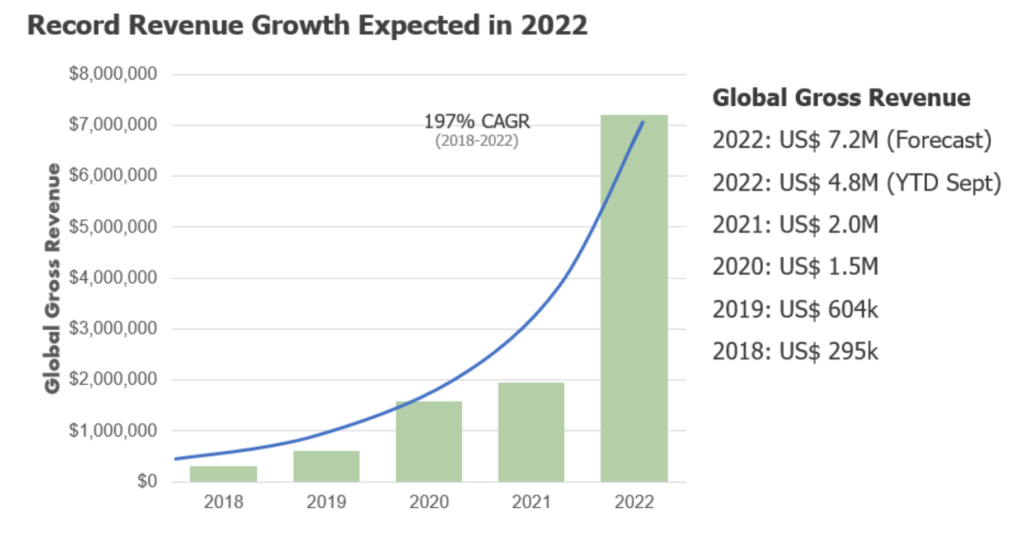

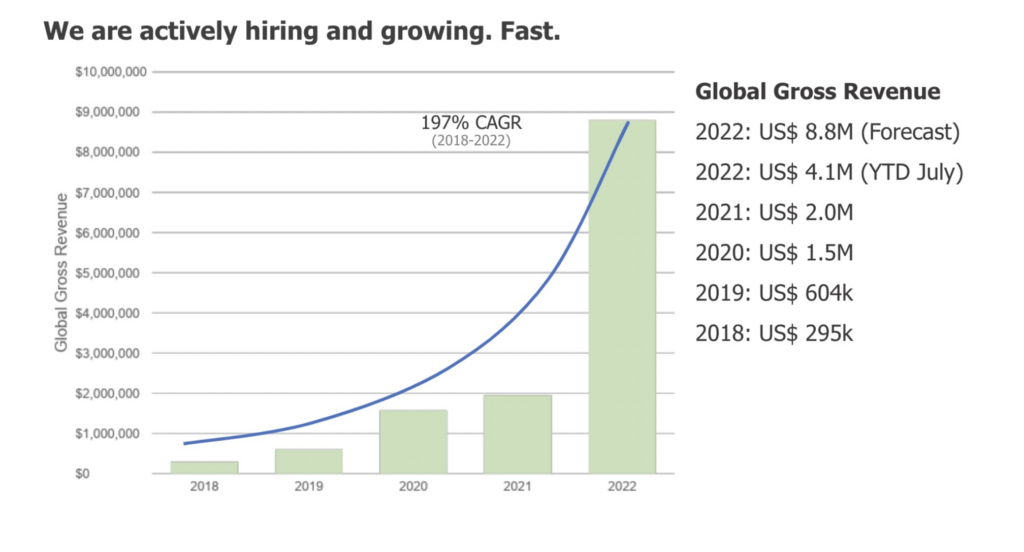

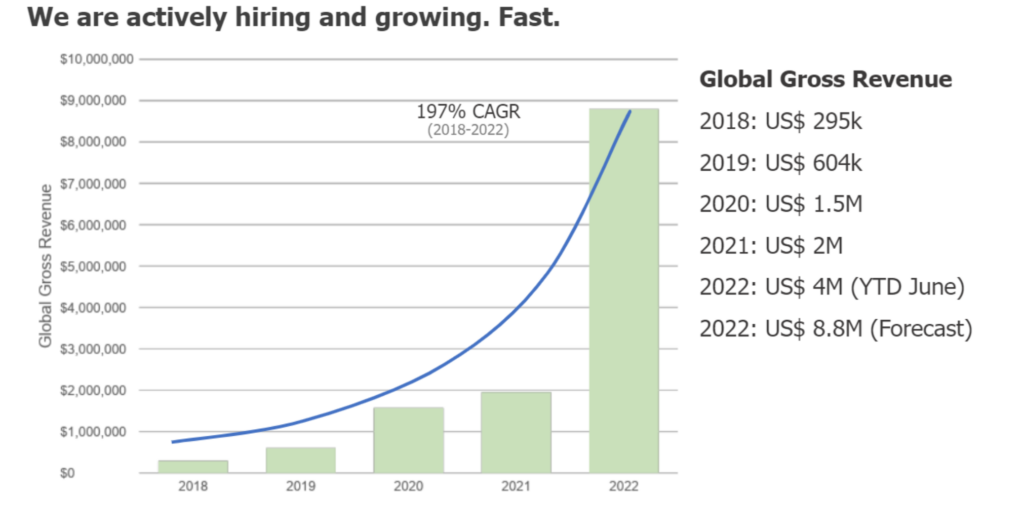

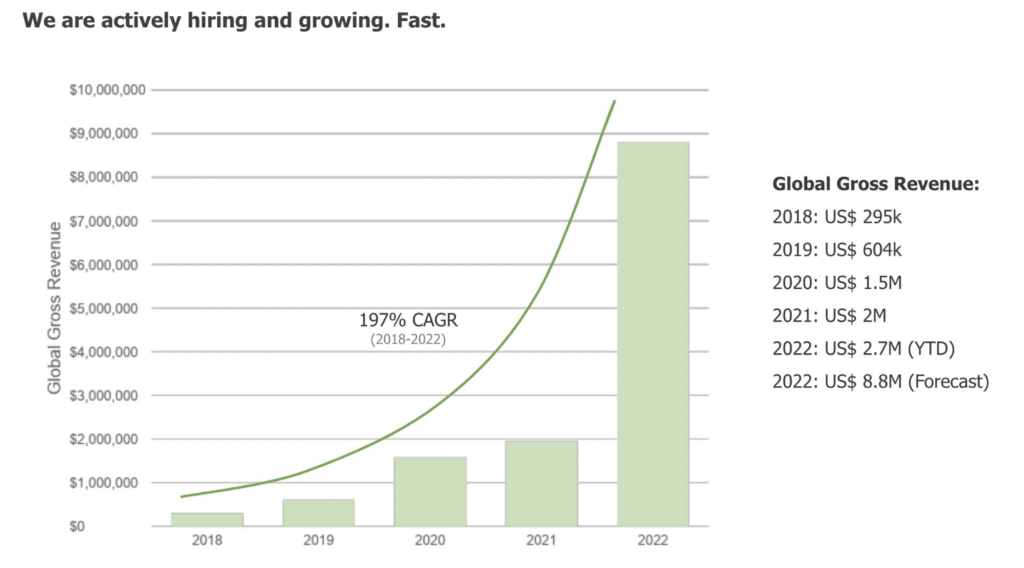

Revenue

First and foremost, we are thrilled to announce that our annual sales have skyrocketed, with a 3x increase in revenue for 2022 closing in at a staggering US$6.1 million. This is a significant accomplishment that showcases the growing demand for our products and services.

Cash & Receivables

We are also pleased to report that our cash and receivables are strong, with US$1.4 million on hand and a steady stream of purchase orders coming in each month. This financial stability provides a solid foundation for our future growth and expansion plans.

Cap Table

We would also like to extend a warm welcome to Michael Blakey, co-founder of Cocoon Capital, who has joined our cap table. His vast experience and knowledge in the industry will be invaluable as we continue to scale and grow.

New Markets

In addition, we are excited to announce that OCEAN has opened up financing opportunities in the UAE, with US$2 million in new purchase orders already secured. This is a significant step forward in expanding our reach and building a global presence.

Building the Future

Lastly, we are proud to have participated in major industry events such as AVCJ and the Procurement Leaders Conference over the past quarter. These events have provided valuable opportunities for networking, learning, and showcasing our products and services to a wider audience.

We are excited for the year ahead and look forward to continued growth and success with the support of our investors, friends and colleagues.

Best Regards,

The OCEAN Team

GROWTH

INDUSTRY EVENTS

Whilst we have attended a number of Industry Events during 2022, in Q4 Ocean was proud to participate in the 35th Annual AVCJ Private Equity & Venture Forum, as well as the Procurement Leaders Conference, which is considered to be Asia’s premier gathering of private market leaders. Our Founder, Vishal, was also honored to be a featured speaker and panelist, showcasing our company’s expertise and thought leadership in the industry.

CUSTOMER SPOTLIGHT

During the last quarter Ocean has taken on a new customer, Villa Cotton, the award winning and socially responsible American bedding, drapery and upholstery company that sources their designs and material from Italy, Our first trade with Villa Cotton was for $80,000 and we look forward to a mutually beneficial relationship as we help them expand their business throughout the US & Canada during 2023 and beyond.

TECHNOLOGY SPOTLIGHT

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

Thanks to all for your support and guidance on this journey!

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello OCEAN Friends,

We’ve been super busy so combining a couple months’ highlights into one newsletter.

- We welcome another new addition to our cap table, Matthew Hoffer, Co-founder of Spire Capital, an investment and advisory firm based in Switzerland.

- OCEAN has drawn down on $1million under our Bedford Row Capital facility and we have already started deploying into new purchase orders.

- Our “employee stack” is expanding with the addition of industry veteran Syam Nair, Chief Technology Officer, on a full-time basis.

- Over the last several weeks we’ve attended invitation only events at the Plug and Play (current investor) in Silicon Valley as well as Milken, SuperReturns & Family Office conferences.

GROWTH

EVENTS & CONFERENCES

We are extremely proud that OCEAN was invited to participate in Plug and Play’s ‘Supply Chain Selection Week Conference‘, connecting the best technology start-ups and the world’s largest corporations to drive change in supply chain & logistics. Plug and Play’s Supply Chain ecosystem consists of 45 bespoke corporate partners and has resulted in over 180 POCs and Pilots being delivered and we look forward to continuing our value-add relationship during our journey.

MANAGEMENT TEAM SPOTLIGHT

CUSTOMER SPOTLIGHT

OCEAN has recently financed a UAE based company, PureBorn, an award-winning organic nappy and baby wipe company founded by Hannah Curran. Pureborn was launched in 2017 and has successfully developed their products to be safe for babies, with organic, sustainable, and compostable formulas and materials, and also provide parents with a healthier alternative & reduced carbon footprint to our planet Earth.

INDUSTRY NEWS

In terms of activity within our space – challenger South African digital bank TymeBank announced that it is acquiring Retail Capital, a fintech company that offers finance to small and medium enterprises.

The acquisition, which is subject to regulatory approvals, will see Retail Capital become a division of TymeBank and the “foundation” of the bank’s expanded business banking offering, it said. TymeBank is majority owned by Patrice Motsepe’s African Rainbow Capital.

TymeBank’s business banking offering already has more than 100,000 customers and their service includes a transactional business account with no monthly bank fees, free debit card and online purchase transactions, and free bulk payments.

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

We plan to start Series A tech demos soon – for an early sneak peek, please feel free to sign up for the Tech Demo here.

CLOSING

Thanks to all for your support and guidance on this journey!

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello OCEAN Friends,

Noteworthy items in this latest update:

- We are excited to welcome veteran Silicon Valley investor Plug And Play Ventures to the Ocean family. Plug and Play have over 30 unicorns in their portfolio and are early investors in PayPal, LendingTree, Dropbox, etc

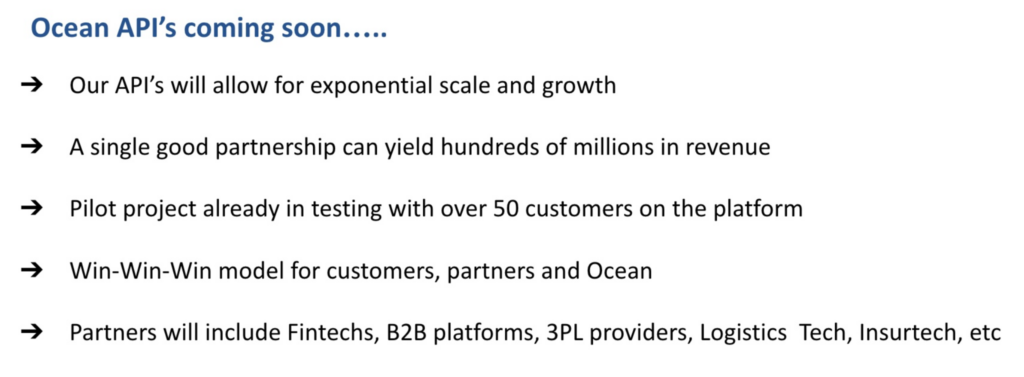

- Our embedded finance API’s are now in development and several platform partnerships are in early discussions (announcements to follow shortly…)

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

INVESTOR SPOTLIGHT

What is Embedded Finance?

Embedded finance is when businesses layer additional financial products (like credit or insurance) on top of their existing products or services.

OPEN POSITIONS

Ocean Product Manager

This candidate should have demonstrable experience in Fintech product management, including a proven-track record of developing and delivering world class financial technology products. You will own the products entirely – customer discovery, user testing, implementation, iterations and be responsible for their success in terms of adoption, engagement, and monetization.

CLOSING

Thanks to all for your support and guidance on this journey!

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Greetings everyone. Noteworthy items in this update include:

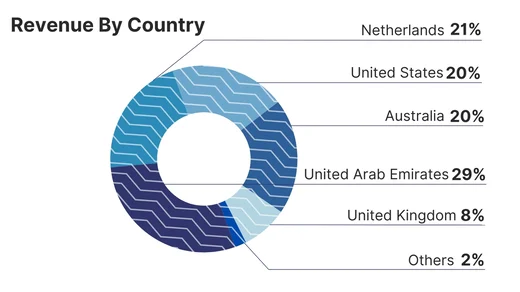

- OCEAN signs US$2.6M contract with InMerc Group for cooking oil supply chain distribution.

- First half 2022 revenues have reached approximately US $4 million, the highest level ever.

- We entered final discussions for the creation of an exclusive offshore development center in Vietnam and India.

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

PRODUCT DEVELOPMENT CONTINUES

Ocean entered final discussions for the creation of an exclusive offshore development center in Vietnam and India.

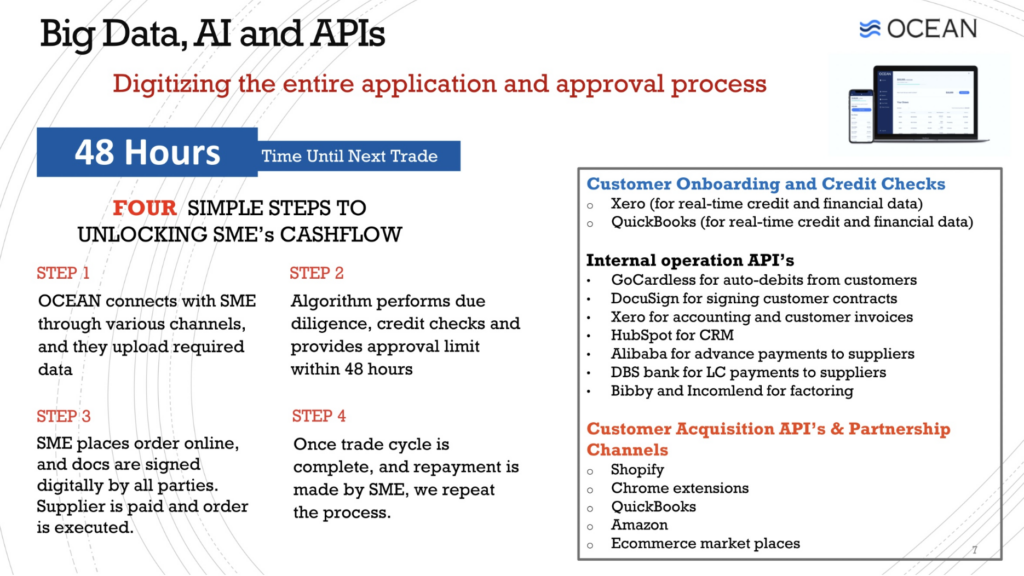

Development work also continues on the OCEAN platform including:

• Onboarding portals for customers (both for SMEs and Suppliers)

• Workflow engine for an easy and smooth onboarding and process flow

• Integration with Xero for automatic pull up of SME financial documents

• Preparation of credit scoring bundle and auto sharing with credit scoring and insurance agencies

OCEAN SIGNS US$ 2.6 MILLION COOKING OIL CONTRACT

OCEAN has signed a US$ 2.6 million supply chain contract with the InMerc Group for cooking and base oils. The company is a large, privately held trading company supplying commodities in and around the Middle East. InMerc supplies a variety of retailers, wholesalers distributors and end users with products sourced globally. They have been handling the import and distribution of items throughout their 20-year trading history.

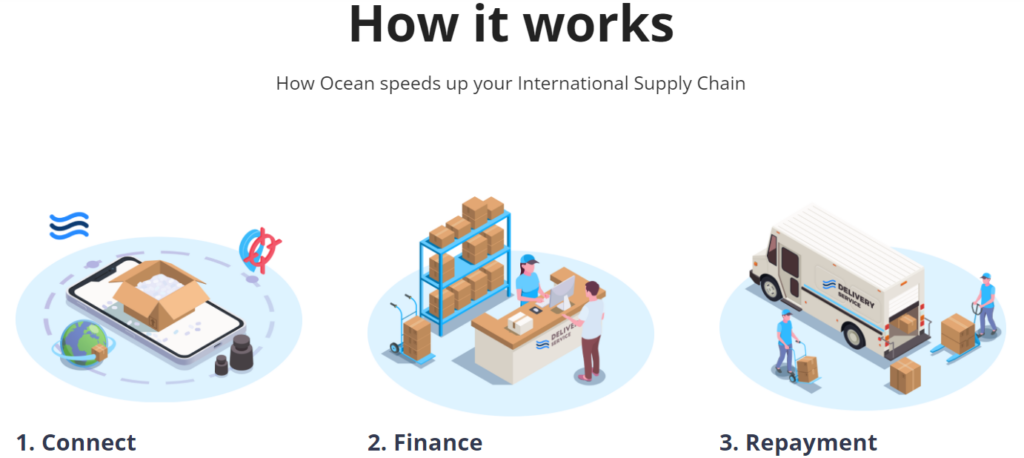

HOW OCEAN PARTNERS WITH SMALL AND MEDIUM SIZED ENTERPRISES

SCENARIO: You’re a medium sized importer and a foreign supplier calls to offer a much sought after product for your inventory.

But you have no cash to deploy so the supplier fills the order with a larger, multinational competitor.

- Flexibility: In these cases, OCEAN can bridge the gap quickly. Payments are made to the supplier in their local currency plus a repayment schedule is customized to meet SME’s needs.

- Convenience: Trade financing requires very little documentation. Setting up a trade finance account for the SME is significantly faster and easier than applying for a bank loan.

- Security: Making transactions with foreign companies may be outside your usual scope. Both you and your client will have the peace of mind of working with a reputable and experienced trading partner like OCEAN.

- Transaction Flow: Funds are available to the SME almost immediately, which means it can improve transaction flow. The trade financing credit may also be maintained on the SME’s books as working capital, not as debt.

EMPLOYEE SPOTLIGHT

WE ARE HIRING

Ocean Product Manager

This candidate should have demonstrable experience in Fintech product management, including a proven-track record of developing and delivering world class financial technology products. You will own the products entirely – customer discovery, user testing, implementation, iterations and be responsible for their success in terms of adoption, engagement, and monetization.

CLOSING

Thanks to all for your support and guidance on this journey!

As we are growing rapidly, please reach out to myself or Mike Donovan if you are interested in equity or debt investments.

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello everyone, our latest newsletter follows. Noteworthy items include:

- Gross revenues reached US$3.3 million through May 2022.

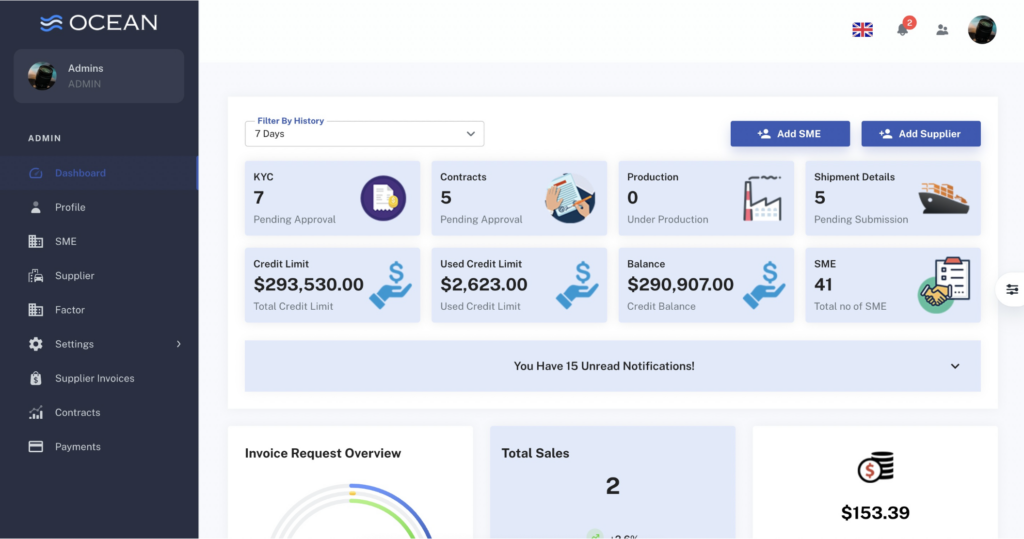

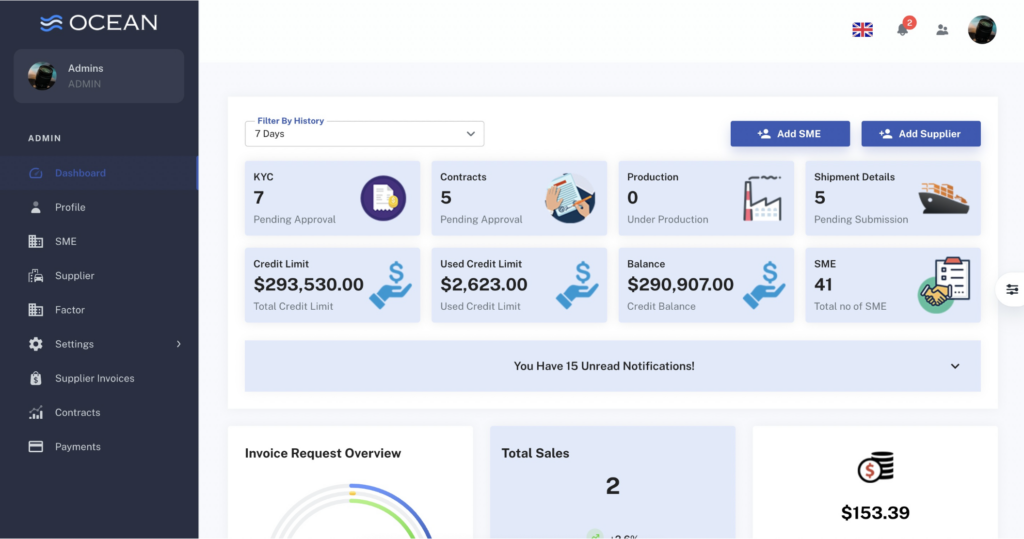

- Our MVP 1.0 is complete – see the included screenshot.

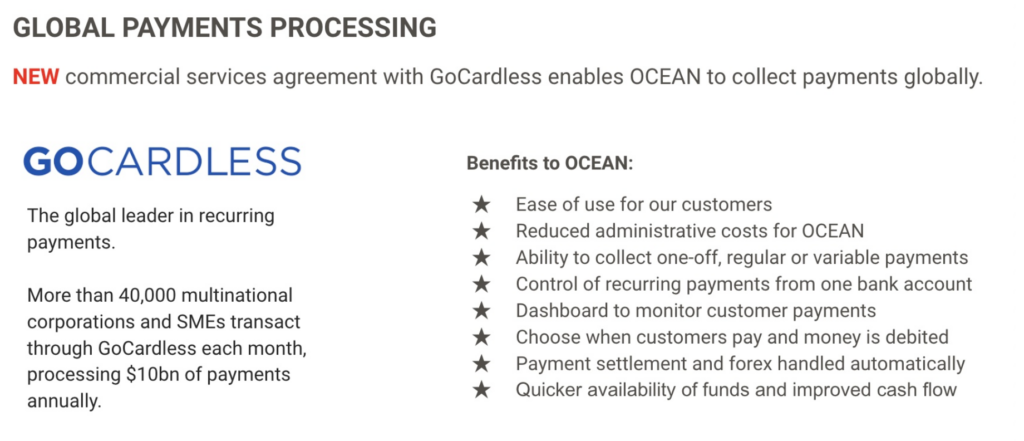

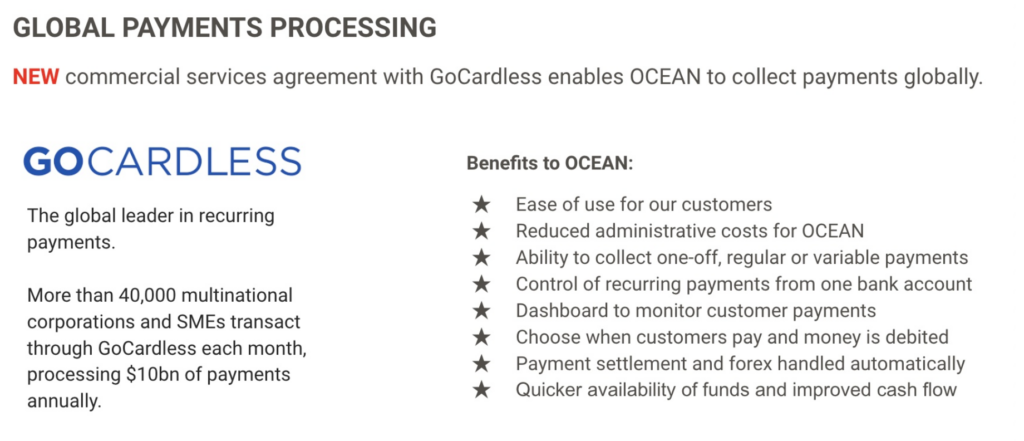

- A new commercial services agreement with GoCardless allows us to collect payments globally, increase cash flow and deploy capital more quickly.

- Supply chain finance is undergoing a technological revolution and Ocean is riding the wave as most banks are using outdated technology.

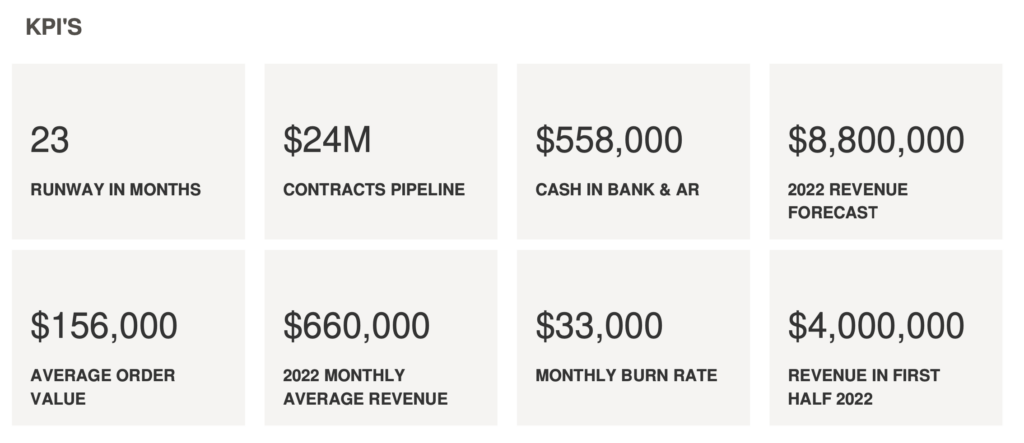

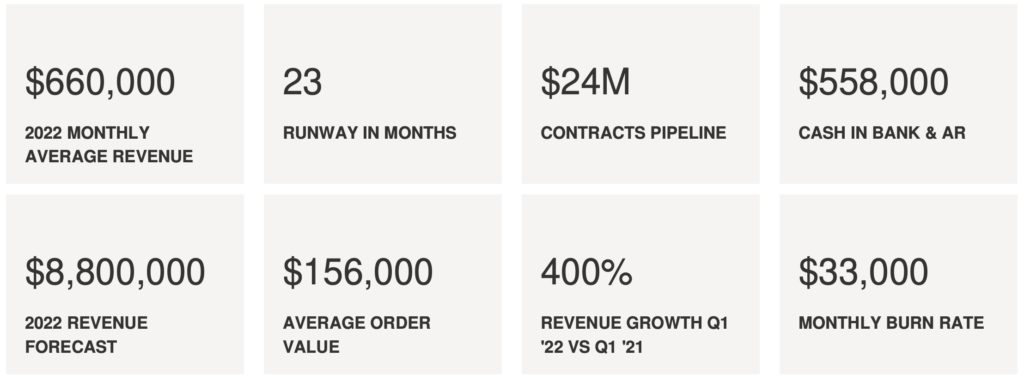

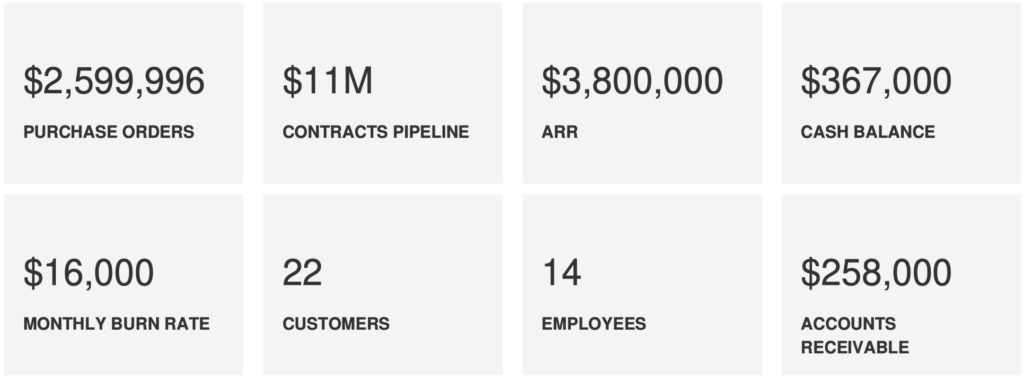

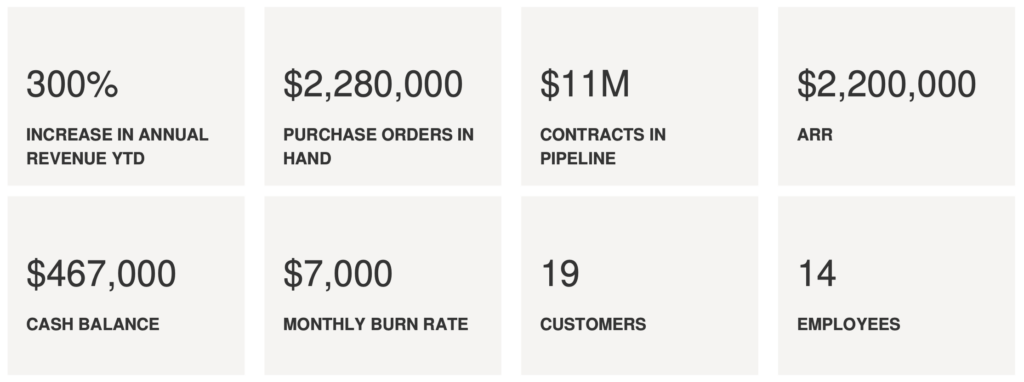

KPI’S

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

TECHNOLOGY

Phase 1 Completed:

- We’re excited to report that version 1.0 of our MVP is completed.

Phase 2 Underway:

- Integration with Codat.io, which is called the gateway of customer and financial data for businesses like OCEAN. This step will allow us to aggregate our customer (SME and Supplier) information into the platform for useful data visualization and predictive analysis.

- Integration of real time payment capabilities with GoCardless. The MVP version will be upgraded to have a full feature auto-debit payment system directly from the customer’s bank account. This will streamline the invoicing capabilities of the existing platform.

- Platform backend capability boosting as well as enhancing Ocean’s web application UX and interfaces as suggested by client trials, which are expected to occur in the second half of this year.

MANAGEMENT TEAM SPOTLIGHT

ADVANCED DASHBOARD AND ANALYTICS

INDUSTRY TRENDS

OCEAN is swimming in the right lane. A recent article highlights that Trade Finance is notorious for its stubbornness to embrace digitisation, but technology has now matured to the point where it is ready to direct the industry onto a more sustainable and efficient path. Inefficiencies mean that nearly US$1.5 trillion of in-demand capital across the industry is rejected by banks, according to the Asian Development Bank, with some 60% of banks expecting this figure to increase over the next two years.

International Trade Finance remains mired in an avalanche of paper, a plethora of conflicting national regulations and processes, and systems that do not communicate well with each other. These burdens, coupled with the industry’s failure to adapt quickly to more modern methods of analyzing credit eligibility, hit medium, small, and microenterprises (MSMEs) particularly hard. As MSMEs account for a large part of total global trade and are the largest employers worldwide, it is far past time for the industry to make changes that provide greater and simpler access.

(Article)

Source- (Global Trade, Trade Finance- IJGlobal)

HIRING THE FOLLOWING

Feel free to reach out if you have know talent in the following areas:

- Chief Operating officer with experience in Fintech or Logistics tech

- Head Of Engineering

- Digital partnerships director (US and UK) x2

CLOSING

Thanks to everyone for your support and guidance on this journey!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

APRIL HIGHLIGHTS

Hello everyone! We’re pleased to send along our latest newsletter with the following highlights:

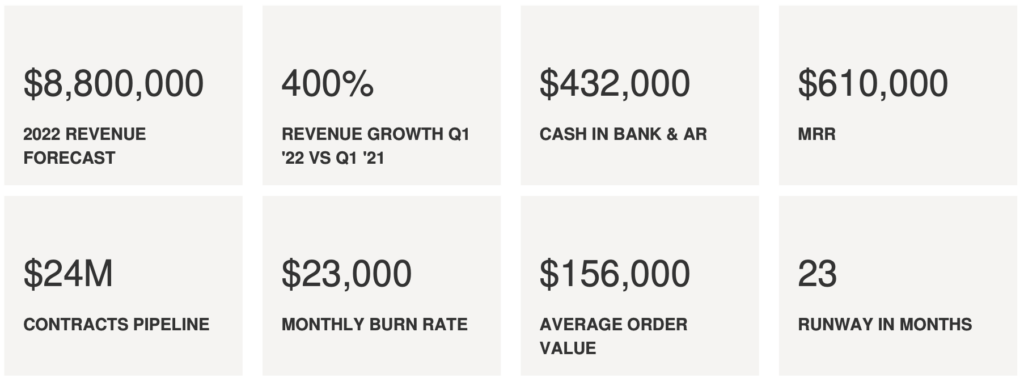

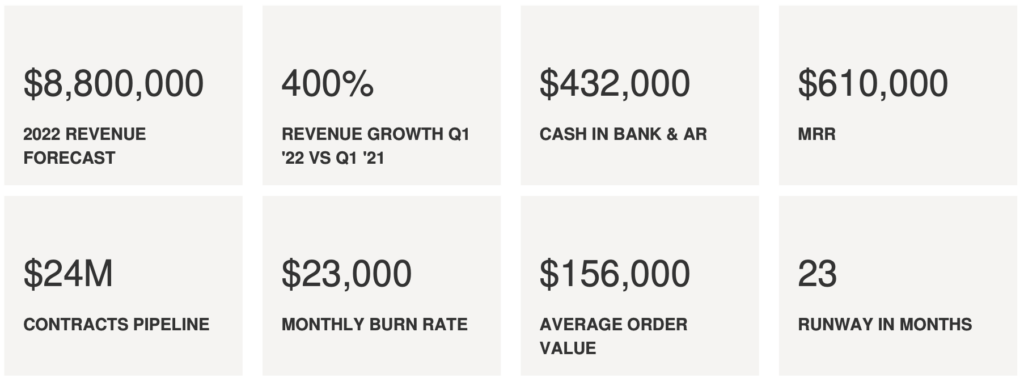

- Market turmoil is creating demand for OCEAN solutions with our order book having grown to US$24 million

- Monthly Recurring Revenue (MRR) has grown to US$ 610,000

- A Strategic Services Agreement with SEQATO for International Payments has been signed

KPI’S

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.]

AI TECHNOLOGY DEVELOPMENT

OPPORTUNITY IN CHAOS

Due to the slowing economy OCEAN has seen a dramatic increase in demand for its supply chain and trade services. Our order book has gone up from US$ 18 million to US$ 24 million in a matter of months.

We are expanding our sales and marketing efforts and deploying capital so that customer order volume can be fulfilled. This will favorably impact our overall revenue and cash flow positions, especially when we consider 2018 performance as a baseline for our company.

Having said that the IMF states in its recent April 2022 report that the [Russian aggression in Ukraine] will slow economic growth significantly. We have seen large spikes in food, energy and real estate prices which make the cost of doing business much higher for all. However, with many companies focused on improving resiliency in the global value chain since COVID took hold, we believe our business could see solid demand. Prospects improve further if the conflict in Eastern Europe and logistics challenges in China can be resolved.

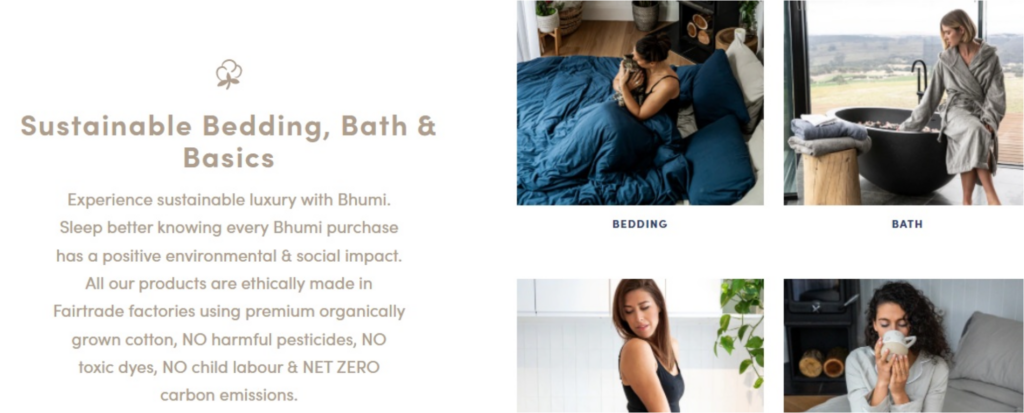

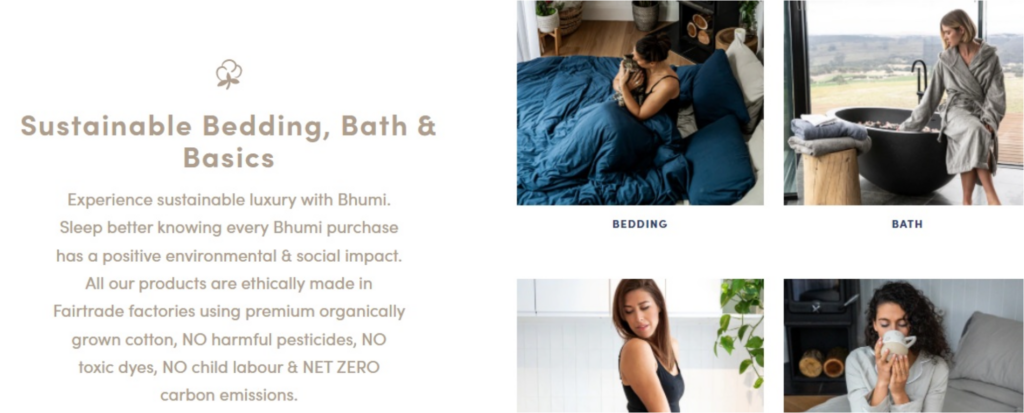

CUSTOMER SPOTLIGHT-BHUMI

OCEAN invested in Australian company Bhumi, which means ‘Mother Earth’ in Sanskrit. The company was founded by Vinita and Dushyant Baravkar. Bedding, bath and apparel make up their product offering which is manufactured in Fairtrade factories with Certified Organic cotton.

“We got funded in 2 weeks. It was a lifesaver. Having an investor on board to be able to buy stock from China during the holiday season was a huge boost to our topline.“

Dushyant Baravkar

Chairman & CEO, Bhumi Australia

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

- Digital partnerships director (US and UK) x2

- Head Of Engineering

We plan to start Series A tech demos by September! So for an early sneak peek, please feel free to sign up for the Tech Demo here. Please feel free to email myself or Mike Donovan.

CLOSING

Thank you to everyone for your support and guidance thus far!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

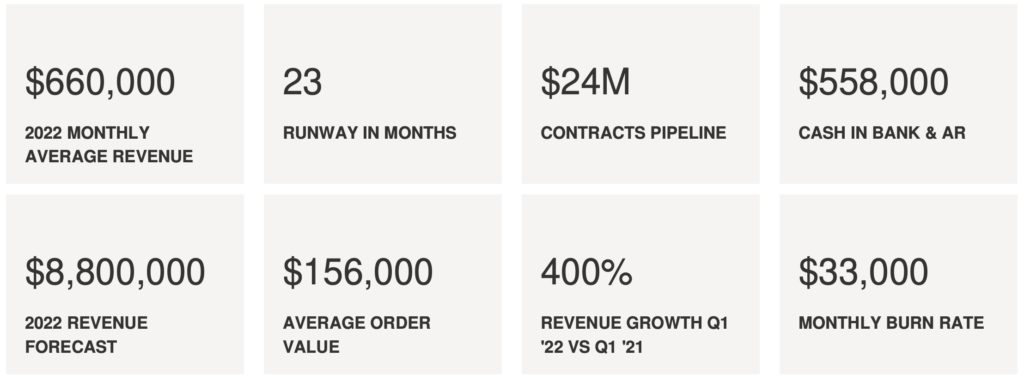

Hello everyone! We’re pleased to send along our March newsletter with the following highlights:

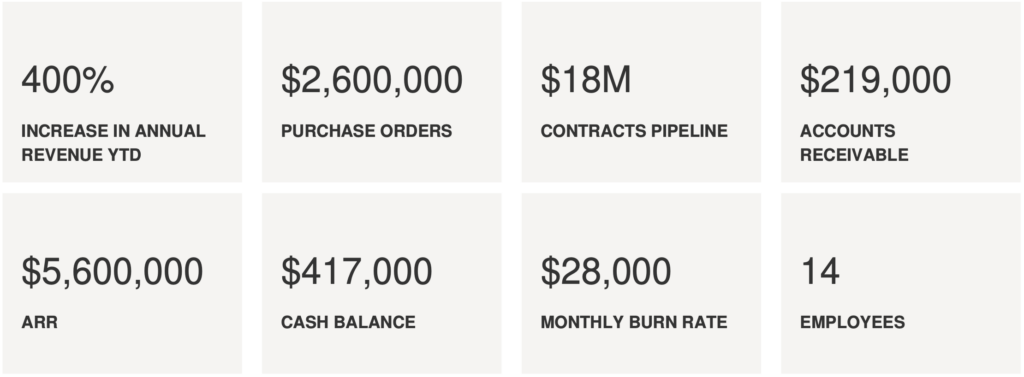

- Sales have grown 400% year over year

- Signed a US$8 million debt facility with Bedford Row Capital

- Finished the year 2021 with US$2.0 million in annual revenue

- Generated first quarter 2022 revenue of US$2.1 million

- Excited to announce the appointment of Bospar, our new PR agency in San Francisco

- Increased pipeline is now approximately US$18 million

KPI’S

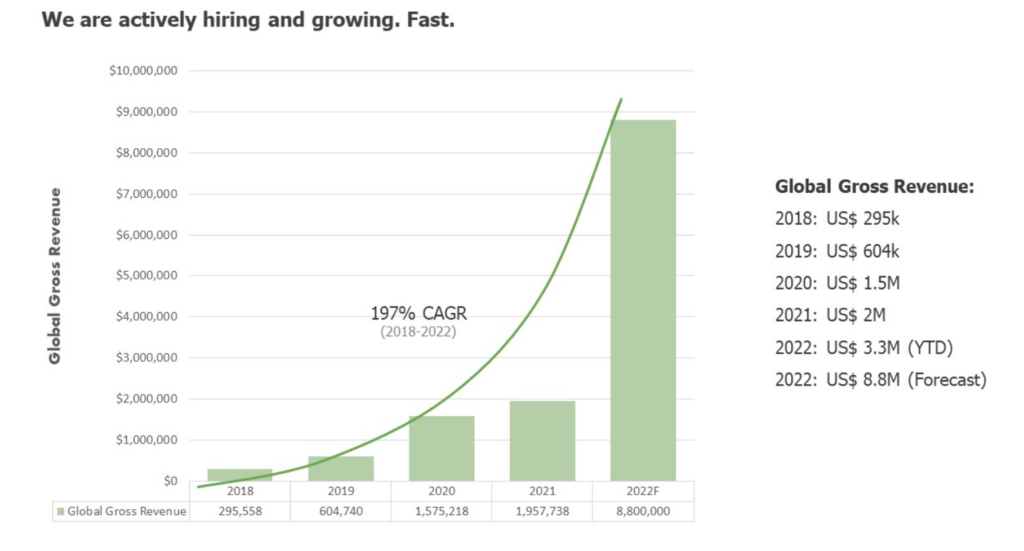

FINANCIAL SUMMARY

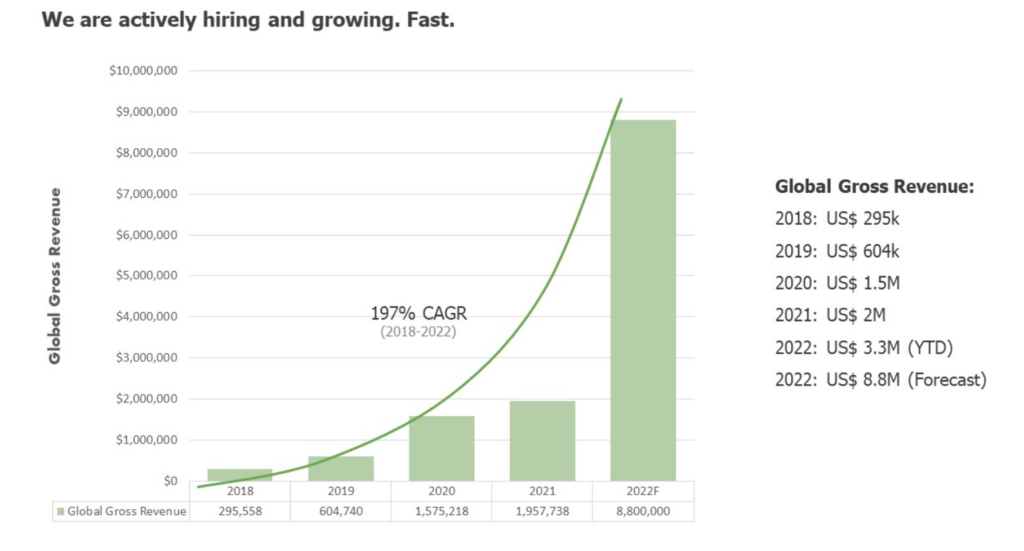

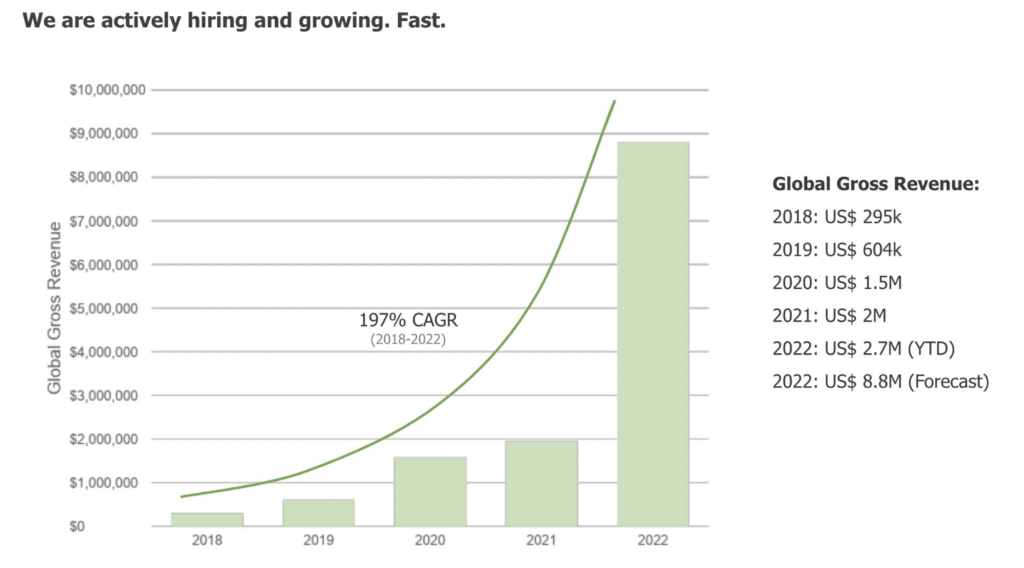

2018 Revenue: US$ 295,558

2019 Revenue: US$ 604,740

2020 Revenue: US$ 1,575,218

2021 Revenue: US$ 1,957,738

2022 YTD Revenue: US$ 2,100,000 (Jan – March)

2022 Revenue: US$ 8,800,000 (forecast)

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.]

INDUSTRY NEWS

Due to the growing conflict between Russia and Ukraine, Europe’s supply chain and leading economies are facing major disruptions. This issue is slowly affecting the rest of the world as well, as indicated by the rising fuel prices in more countries.

Supply chain disruptions are accelerating innovation and digital transformation according to the Globe street article. The Wired Article highlighting tech’s role in this ancient industry was quite interesting.

Ocean aims to be at the forefront of global supply chain finance innovation for SME’s by allowing them to address production finance, shipping, purchase order finance, import finance and supply chain finance all at the same time with just two innovative products.

CUSTOMER SPOTLIGHT – RIGORER

OCEAN invested in the distribution of sports apparel Rigorer in South East Asia. The brand was founded by Mr. Lin Chenyao, a former player with the Chinese Basketball Association. Rigorer cites a workforce of 1200 employees, 50 designers, 29 online stores and 50 physical stores, 300 distributors and approximately US$80 million in annual revenue.

OCEAN helps finance the China to Singapore supply chain for the company. We love investing in good quality businesses like Rigorer, especially where we can increase efficiency in the supply chain, grow their market and have a positive social impact.

PRODUCT & TECHNOLOGY POSITIONS

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Head of Sales

- Chief Operating officer with experience in Fintech or Logistics tech

- Digital partnerships director (US and UK) x2

- Head Of Engineering x 1

We plan to start Series A tech demos by July! So for an early sneak peek, please feel free to sign up for the Tech Demo here.

HOW CAN YOU HELP?

We are looking at:

- Strategic partnerships with Digital Banks, and platforms that deal with SME customers

- Businesses like Rigorer who could benefit from increased Working Capital flexibility, and breathing space to refocus their efforts on growing their business.

Please feel free to email myself or Mike Donovan.

CLOSING

Thank you to everyone for your support and guidance thus far!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

We hope you are well and staying safe. Some noteworthy items:

- We closed 2021 with US$2.1 million in annual revenue

- Last 2 months alone we did US$1.3 million in revenue

- Our MVP is live and trading

- We have US$11 million in purchase orders in our 2022 pipeline

- We have two new team members this month

- We are currently interviewing PR agencies to announce the round close and come out of stealth mode

Due to the global COVID supply chain disruptions and political landscape we are seeing companies looking to diversify their supply chain. We are also seeing an increase in funding and demand for supply chain innovation as outlined in this.

KPI’S

OUR TEAM IS GROWING

FINANCIALS SUMMARY

2018 Revenue: US$ 124,788 (actual)

2019 Revenue: US$ 406,168 (actual)

2020 Revenue: US$ 1,055,632 (actual)

2021 Revenue: US$ 2,100,000 (actual)

2022 Revenue: US$ 8,800,000 (forecast)

2022 YTD Revenue: US$ 1,300,000 (Jan & Feb)

We invested in sustainable luxury with Bhumi Australia. Every Bhumi purchase has a positive environmental & social impact. All their products are ethically made in Fairtrade factories using premium, organically grown cotton; No harmful pesticides, No toxic dyes, No child labour & Net Zero carbon emissions.

We help finance their supply chain from India to Australia. We love investing in small good quality businesses especially where we can increase efficiency in the supply chain, grow their market and have a positive social impact.

PRODUCT & TECHNOLOGY

Just a reminder that we are currently hiring:

▪ Head Of Engineering x 1

▪ Full stack Data Scientist x 1

▪ Product Manager x 1

▪ Backend Python Django developers x 5

▪ ReactJS front end developers x 3

▪ Data Scientist x 1

▪ Full stack ML Engineers x 2

▪ DevOps/Infra Engineer x 1

▪ QA x 2

We plan to start Series A tech demos by July! For an early sneak peek beforehand please feel free to sign up for an early Tech Demo here.

HOW CAN YOU HELP?

We are currently looking for:

- A Chief Operating officer with experience in Fintech or Logistics tech

- 2 x Digital partnerships director (US and UK)

- Strategic partnerships with Digital banks and platforms that deal with SME customers

- Strategic Investors to close out the existing round

Any help would be appreciated! Please feel free to email myself or Mike Donovan.

CLOSING

We would like to thank everyone for their support and guidance so far.

You can join other investors and book an early Tech Demo here, ahead of the Series A. Thanks!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN

https://www.thisisocean.com

https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Happy New Year!

2021 was a tremendous year for our company so thank you for your support.

Some noteworthy items:

- In 2021 OCEAN surpassed US$2 million in annual revenue for the first time!

- Two leading VC funds have committed US$1.8M to the Pre-series A round, which will be closing in Q1 2022

- Our MVP is live and trading

- We have US$11 million in purchase orders in our 2022 pipeline

- We have two new team members this month

CURRENT ROUND – PRE SERIES A

US$ 2,500,000 (Hard Cap US$5 million)

US$1,800,000 equity committed

US$5,000,000 debt committed

With only US$700k left in the round we have increased the hard cap to US$5 million to make space on the cap table for strategic investors as many VC funds have minimum check sizes or equity requirements.

We are now looking to close out the round.

KPI’S

OUR TEAM IS GROWING

NEW MEMBERS

We would like to welcome Michael and Anthony to the fold!

Michael Donovan has served as a Founder and CEO of a startup, a strategic advisor and a long-time veteran of Deloitte.

Anthony Garcia comes to us with VC, financial services and derivatives experience and is a graduate of The University of Arizona. We are humbled that the management team alone is investing close to US$500,000 outside of the round!

FINANCIALS

2018 Revenue: US$ 124,788 (actual)

2019 Revenue: US$ 406,168 (actual)

2020 Revenue: US$ 1,055,632 (actual)

2021 Revenue: US$ 2,100,000 (actual)

2022 Revenue: US$ 8,800,000 (forecast)

We expect the current round to position us for the Series A raise in 2022 at an approximate US$130-170 million pre money valuation.

2021 Pre Series A: US$28 million pre money Valuation (current round), or 14x 2021 Revenues

2022 Series A: ~US$150 million pre money Valuation, with raise to occur in 2Q/3Q22 or 15x 2022 ARR

PRODUCT & TECHNOLOGY

Just a reminder that we are currently hiring:

▪ Head Of Engineering x 1

▪ Full stack Data Scientist x 1

▪ Product Manager x 1

▪ Backend Python Django developers x 5

▪ ReactJS front end developers x 3

▪ Data Scientist x 1

▪ Full stack ML Engineers x 2

▪ DevOps/Infra Engineer x 1

▪ QA x 2

We plan to start proper Series A tech demos by April! For a sneak peek before hand please feel free to sign up for a tech demo here.

HOW CAN YOU HELP?

We are currently looking for:

• A Chief Operating officer with experience in Fintech or Logistics tech

• 2 x Digital partnerships director (US and UK)

• Strategic partnerships with Digital banks and platforms that deal with SME customers • Strategic Investors to close out the existing round

Any help would be appreciated! Please feel free to email myself or Mike Donovan.

CLOSING

We would like to thank everyone for their support and guidance so far. And we hope to see many of you in person during 2022!

You can join other investors and book an early tech demo here now ahead of the series A. We wish you a prosperous and safe 2022!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN

https://www.thisisocean.com

https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here now to catch up in the new year.

- 2022

- Tab Title 2

- Tab Title 3

- 07/2022

- 08/2022

- 09/2022

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello everyone, our latest newsletter follows. Noteworthy items include:

- Gross revenues reached US$3.3 million through May 2022.

- Our MVP 1.0 is complete – see the included screenshot.

- A new commercial services agreement with GoCardless allows us to collect payments globally, increase cash flow and deploy capital more quickly.

- Supply chain finance is undergoing a technological revolution and Ocean is riding the wave as most banks are using outdated technology.

KPI’S

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

TECHNOLOGY

Phase 1 Completed:

- We’re excited to report that version 1.0 of our MVP is completed.

Phase 2 Underway:

- Integration with Codat.io, which is called the gateway of customer and financial data for businesses like OCEAN. This step will allow us to aggregate our customer (SME and Supplier) information into the platform for useful data visualization and predictive analysis.

- Integration of real time payment capabilities with GoCardless. The MVP version will be upgraded to have a full feature auto-debit payment system directly from the customer’s bank account. This will streamline the invoicing capabilities of the existing platform.

- Platform backend capability boosting as well as enhancing Ocean’s web application UX and interfaces as suggested by client trials, which are expected to occur in the second half of this year.

MANAGEMENT TEAM SPOTLIGHT

ADVANCED DASHBOARD AND ANALYTICS

INDUSTRY TRENDS

OCEAN is swimming in the right lane. A recent article highlights that Trade Finance is notorious for its stubbornness to embrace digitisation, but technology has now matured to the point where it is ready to direct the industry onto a more sustainable and efficient path. Inefficiencies mean that nearly US$1.5 trillion of in-demand capital across the industry is rejected by banks, according to the Asian Development Bank, with some 60% of banks expecting this figure to increase over the next two years.

International Trade Finance remains mired in an avalanche of paper, a plethora of conflicting national regulations and processes, and systems that do not communicate well with each other. These burdens, coupled with the industry’s failure to adapt quickly to more modern methods of analyzing credit eligibility, hit medium, small, and microenterprises (MSMEs) particularly hard. As MSMEs account for a large part of total global trade and are the largest employers worldwide, it is far past time for the industry to make changes that provide greater and simpler access.

(Article)

Source- (Global Trade, Trade Finance- IJGlobal)

HIRING THE FOLLOWING

Feel free to reach out if you have know talent in the following areas:

- Chief Operating officer with experience in Fintech or Logistics tech

- Head Of Engineering

- Digital partnerships director (US and UK) x2

CLOSING

Thanks to everyone for your support and guidance on this journey!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

APRIL HIGHLIGHTS

Hello everyone! We’re pleased to send along our latest newsletter with the following highlights:

- Market turmoil is creating demand for OCEAN solutions with our order book having grown to US$24 million

- Monthly Recurring Revenue (MRR) has grown to US$ 610,000

- A Strategic Services Agreement with SEQATO for International Payments has been signed

KPI’S

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.]

AI TECHNOLOGY DEVELOPMENT

OPPORTUNITY IN CHAOS

Due to the slowing economy OCEAN has seen a dramatic increase in demand for its supply chain and trade services. Our order book has gone up from US$ 18 million to US$ 24 million in a matter of months.

We are expanding our sales and marketing efforts and deploying capital so that customer order volume can be fulfilled. This will favorably impact our overall revenue and cash flow positions, especially when we consider 2018 performance as a baseline for our company.

Having said that the IMF states in its recent April 2022 report that the [Russian aggression in Ukraine] will slow economic growth significantly. We have seen large spikes in food, energy and real estate prices which make the cost of doing business much higher for all. However, with many companies focused on improving resiliency in the global value chain since COVID took hold, we believe our business could see solid demand. Prospects improve further if the conflict in Eastern Europe and logistics challenges in China can be resolved.

CUSTOMER SPOTLIGHT-BHUMI

OCEAN invested in Australian company Bhumi, which means ‘Mother Earth’ in Sanskrit. The company was founded by Vinita and Dushyant Baravkar. Bedding, bath and apparel make up their product offering which is manufactured in Fairtrade factories with Certified Organic cotton.

“We got funded in 2 weeks. It was a lifesaver. Having an investor on board to be able to buy stock from China during the holiday season was a huge boost to our topline.“

Dushyant Baravkar

Chairman & CEO, Bhumi Australia

HOW CAN YOU HELP?

We’re hiring so please share these open positions with your network:

- Chief Marketing Officer

- Chief Operating officer with experience in Fintech or Logistics tech

- Digital partnerships director (US and UK) x2

- Head Of Engineering

We plan to start Series A tech demos by September! So for an early sneak peek, please feel free to sign up for the Tech Demo here. Please feel free to email myself or Mike Donovan.

CLOSING

Thank you to everyone for your support and guidance thus far!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

We hope you are well and staying safe. Some noteworthy items:

- We closed 2021 with US$2.1 million in annual revenue

- Last 2 months alone we did US$1.3 million in revenue

- Our MVP is live and trading

- We have US$11 million in purchase orders in our 2022 pipeline

- We have two new team members this month

- We are currently interviewing PR agencies to announce the round close and come out of stealth mode

Due to the global COVID supply chain disruptions and political landscape we are seeing companies looking to diversify their supply chain. We are also seeing an increase in funding and demand for supply chain innovation as outlined in this.

KPI’S

OUR TEAM IS GROWING

FINANCIALS SUMMARY

2018 Revenue: US$ 124,788 (actual)

2019 Revenue: US$ 406,168 (actual)

2020 Revenue: US$ 1,055,632 (actual)

2021 Revenue: US$ 2,100,000 (actual)

2022 Revenue: US$ 8,800,000 (forecast)

2022 YTD Revenue: US$ 1,300,000 (Jan & Feb)

We invested in sustainable luxury with Bhumi Australia. Every Bhumi purchase has a positive environmental & social impact. All their products are ethically made in Fairtrade factories using premium, organically grown cotton; No harmful pesticides, No toxic dyes, No child labour & Net Zero carbon emissions.

We help finance their supply chain from India to Australia. We love investing in small good quality businesses especially where we can increase efficiency in the supply chain, grow their market and have a positive social impact.

PRODUCT & TECHNOLOGY

Just a reminder that we are currently hiring:

▪ Head Of Engineering x 1

▪ Full stack Data Scientist x 1

▪ Product Manager x 1

▪ Backend Python Django developers x 5

▪ ReactJS front end developers x 3

▪ Data Scientist x 1

▪ Full stack ML Engineers x 2

▪ DevOps/Infra Engineer x 1

▪ QA x 2

We plan to start Series A tech demos by July! For an early sneak peek beforehand please feel free to sign up for an early Tech Demo here.

HOW CAN YOU HELP?

We are currently looking for:

- A Chief Operating officer with experience in Fintech or Logistics tech

- 2 x Digital partnerships director (US and UK)

- Strategic partnerships with Digital banks and platforms that deal with SME customers

- Strategic Investors to close out the existing round

Any help would be appreciated! Please feel free to email myself or Mike Donovan.

CLOSING

We would like to thank everyone for their support and guidance so far.

You can join other investors and book an early Tech Demo here, ahead of the Series A. Thanks!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN

https://www.thisisocean.com

https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Meet The Team

Vishal Harishchandra

Founder & CEO

Vishal Harishchandra

Founder & CEO

- Phone:+1 (859) 254-6589

- Email:info@example.com

Mitchell Lock

CMO

Mitchell Lock

CMO

- Phone:+1 (859) 254-6589

- Email:info@example.com

Mike Donovan

Business Development

Mike Donovan

Business Development

- Phone:+1 (859) 254-6589

- Email:info@example.com

Anthony Garcia

Business Development

Anthony Garcia

Business Development

- Phone:+1 (859) 254-6589

- Email:info@example.com

Orgilchimeg Ishdorj

Admin

Orgilchimeg Ishdorj

Admin

- Phone:+1 (859) 254-6589

- Email:info@example.com