Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Happy Holidays to all!

Today I’m excited to share our first OCEAN newsletter.

2021 has been a tremendous year for our company so thank you for your support. Newsworthy items include:

- We have just crossed US$2 million in annual revenue for the first time

- We launched our pre-Series A equity raise this year

- We already have US$$1.8M of the round committed by leading VCs

- We have recently signed two new bluechip advisors and investors namely, Mr Guillaume Leger (Ex Citibank CFO Hong Kong), and Mr Stefan Rothlin (Ex Kuehne + Nagel Senior Regional Vice President SEA).

- Our MVP and trade finance platform is live and trading

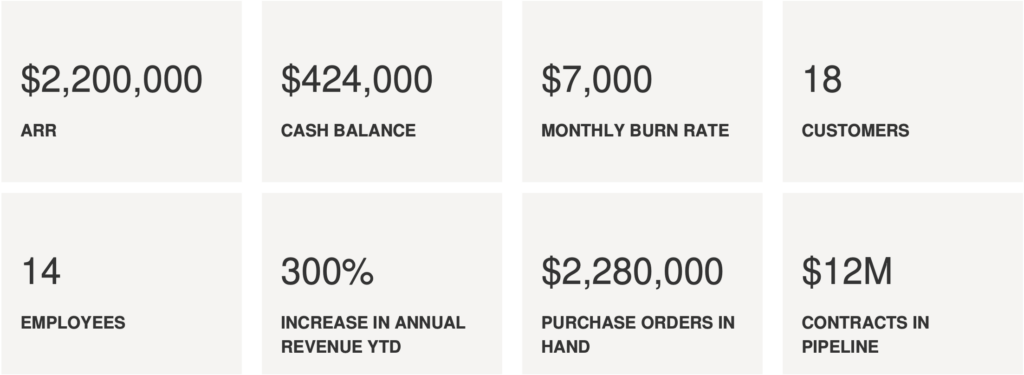

KPI’S

TEAM

We welcome two new blue chip advisors and investors, Mr Guillaume Leger (Ex Citibank CFO Hong Kong) and Mr Stefan Rothlin (Ex Kuehne + Nagel Senior Regional Vice President SEA).

Mr Stefan Rothlin is a financial leader, with more than 25 years experience in Finance and Logistics. Kuehne + Nagel is a leading transport and logistics company based in Switzerland. It accounts for nearly 15% of the world’s air and sea freight business by revenue with more than US$20 billion revenue, 1,336 offices in 109 countries, with around 82,000 employees.

Mr Guillaume Leger, CPA CA, CFA, is a banking professional with over 25 years of experience in multiple jurisdictions, including 15 years with Citigroup. He was CFO of Citi Hong Kong until the end of 2020 and supported a large number of transactions in M&A, lending, supply finance, wealth management and consumer banking.

We are humbled that the management team alone is investing close to US$500,000 outside of the round!

FINANCIALS

Currently, we are in the pre series A round with most of it committed.

We already have US$$1.8M committed by leading VCs, with only US$700k left in the round. So we have increased the hard cap to US$5 million to make space on the cap table for strategic investors. We are now looking to close out the round.

2018 Revenue: US$ 124,788 (actual)

2019 Revenue: US$ 406,168 (actual)

2020 Revenue: US$ 1,055,632 (actual)

2021 Revenue: US$ 2,100,000 (forecast)

We expect the current round will help us achieve a US$10-12 million annual revenue run rate and position us for the Series A raise in 2022 at an approximate US$130- 170 million pre money valuation.

2021 Pre Series A: US$28 million pre money Valuation (current round), or 14.7x multiple of 2020 Revenues

2022 Series A: ~US$150 million pre money Valuation, with raise to occur in 2Q/3Q22.

CUSTOMERS

Ocean has signed new monthly trade contracts of US$4 million in consumer electronics and gold ornaments over 12 months increasing our pipeline to over US$12 million. With the money raised in this Pre series A round we expect to increase the revenue run rate to over US$1 million per month next year. We currently have 18 active customers.

PRODUCT & TECHNOLOGY

So excited that our platform is now live and the team is conducting initial tech demos ahead of the Series A round.

We are currently hiring:

▪ Head Of Engineering x 1

▪ Full stack Data Scientist x 1

▪ Product Manager x 1

▪ Backend Python Django developers x 5

▪ ReactJS front end developers x 3

▪ Data Scientist x 1

▪ Full stack ML Engineers x 2

▪ DevOps/Infra Engineer x 1

▪ QA x 2

We plan to start proper Series A tech demos by April! For a sneak peek before hand please feel free to sign up for a tech demo here.

MARKETPLACE NEWS

As many of you know, supply chain issues have been a challenge for all companies, but despite shipment delays SMEs are still actively pursuing financing for their business needs and our pipeline is growing.

A recent report by the Asian Development Bank confirms that there is a large gap that banks are not filling in the supply chain. According to their latest survey here, “despite various measures to support small and medium sized enterprises during the pandemic, 40% of trade finance applications rejected by banks were from SMEs.”

According to Pitchbook:

- During the third quarter of 2021, the median pre-money valuation for VC-backed, late-stage fintech was $265 million.

- Early-stage median valuations continue to reach new highs, at $40 million—up from $35 million in 2Q21.

- Valuation multiples have also continued to climb, with the median reaching 21.7x revenue in 3Q21 from 19.5x in 2Q21. If this holds through the end of the year, it will represent the highest recorded median revenue multiple for VC backed fintech companies in a single year.

Have a read of this article regarding automation and digitisation of Trade finance, which we found fascinating.

HOW CAN YOU HELP?

We would like to close out the current round, ramp up the tech, engineering team and sales. We are looking for:

- A Chief Operating officer with experience in Fintech or Logistics tech

- A Digital partnerships director

- Strategic partnerships with Digital banks and platforms that deal with SME customers

- Strategic Investors to close out the existing round

Any help would be appreciated! Please feel free to email myself or Mike Donovan.

CLOSING

We would like to thank everyone for their support and guidance. It’s been an exciting year and we look forward to seeing you in person in 2022!

You can join other investors and book an early tech demo now ahead of the series A here.

Please feel free to drop any time in the calendar here now to catch up in the new year.

Wishing you and your loved ones a Merry Christmas. Stay safe!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/