Let’s Make a Trade Enabling Global Trade for SME’s

SUMMARY

Hello everyone, our latest newsletter follows. Noteworthy items include:

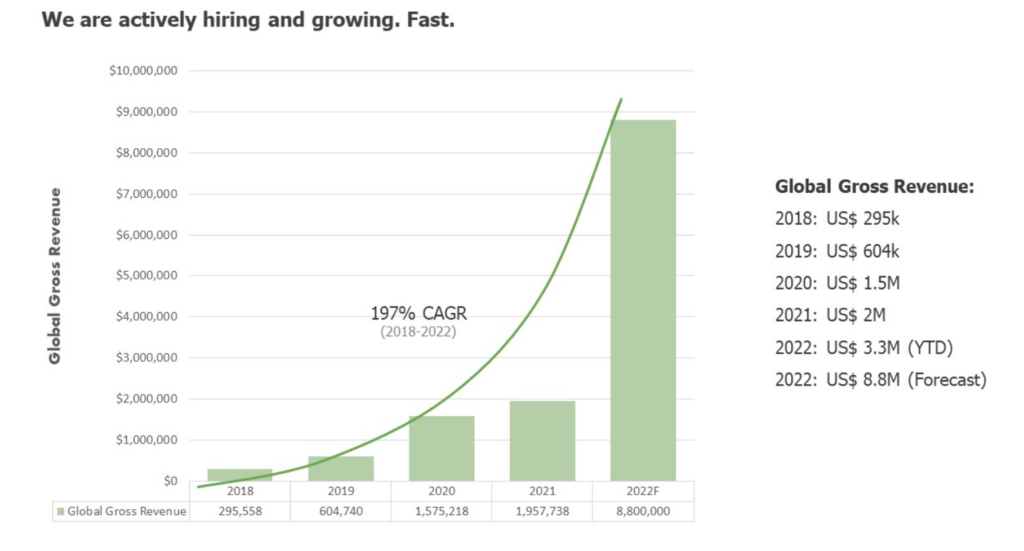

- Gross revenues reached US$3.3 million through May 2022.

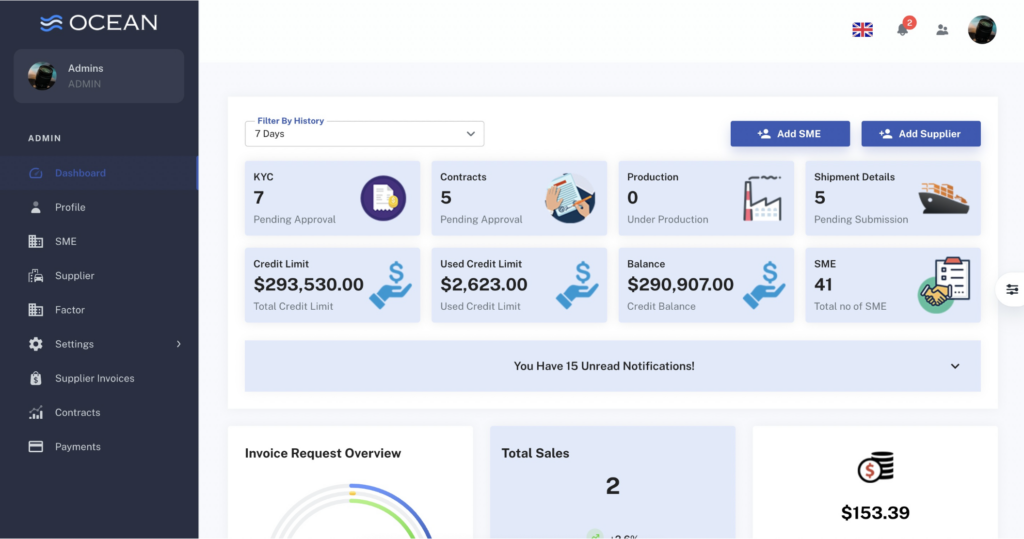

- Our MVP 1.0 is complete – see the included screenshot.

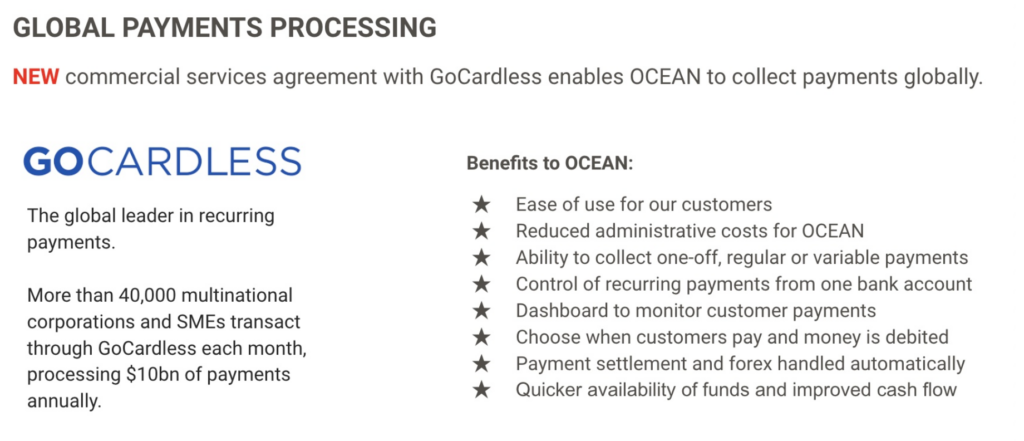

- A new commercial services agreement with GoCardless allows us to collect payments globally, increase cash flow and deploy capital more quickly.

- Supply chain finance is undergoing a technological revolution and Ocean is riding the wave as most banks are using outdated technology.

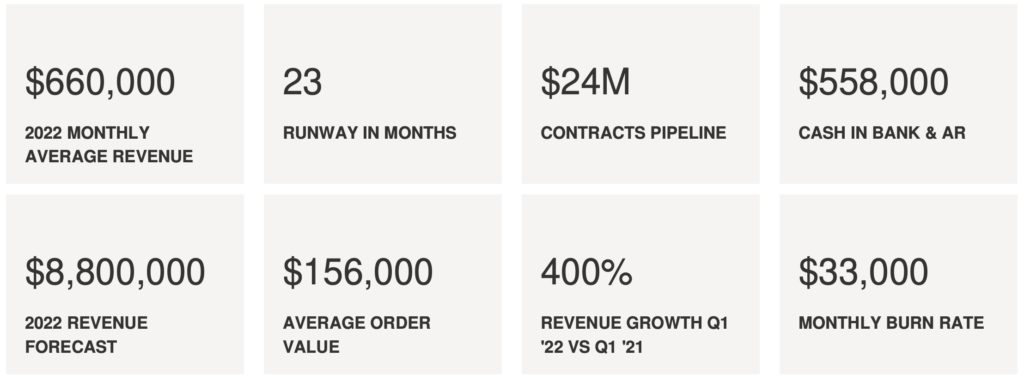

KPI’S

GROWTH

*Please note that Revenue numbers for all the above periods have been updated to reflect OCEAN’s transition to calendar year reporting [Jan.- Dec.] Revenues shown are the Value of Invoices

TECHNOLOGY

Phase 1 Completed:

- We’re excited to report that version 1.0 of our MVP is completed.

Phase 2 Underway:

- Integration with Codat.io, which is called the gateway of customer and financial data for businesses like OCEAN. This step will allow us to aggregate our customer (SME and Supplier) information into the platform for useful data visualization and predictive analysis.

- Integration of real time payment capabilities with GoCardless. The MVP version will be upgraded to have a full feature auto-debit payment system directly from the customer’s bank account. This will streamline the invoicing capabilities of the existing platform.

- Platform backend capability boosting as well as enhancing Ocean’s web application UX and interfaces as suggested by client trials, which are expected to occur in the second half of this year.

MANAGEMENT TEAM SPOTLIGHT

ADVANCED DASHBOARD AND ANALYTICS

INDUSTRY TRENDS

OCEAN is swimming in the right lane. A recent article highlights that Trade Finance is notorious for its stubbornness to embrace digitisation, but technology has now matured to the point where it is ready to direct the industry onto a more sustainable and efficient path. Inefficiencies mean that nearly US$1.5 trillion of in-demand capital across the industry is rejected by banks, according to the Asian Development Bank, with some 60% of banks expecting this figure to increase over the next two years.

International Trade Finance remains mired in an avalanche of paper, a plethora of conflicting national regulations and processes, and systems that do not communicate well with each other. These burdens, coupled with the industry’s failure to adapt quickly to more modern methods of analyzing credit eligibility, hit medium, small, and microenterprises (MSMEs) particularly hard. As MSMEs account for a large part of total global trade and are the largest employers worldwide, it is far past time for the industry to make changes that provide greater and simpler access.

(Article)

Source- (Global Trade, Trade Finance- IJGlobal)

HIRING THE FOLLOWING

Feel free to reach out if you have know talent in the following areas:

- Chief Operating officer with experience in Fintech or Logistics tech

- Head Of Engineering

- Digital partnerships director (US and UK) x2

CLOSING

Thanks to everyone for your support and guidance on this journey!

Vishal H. Kewalramani

Chairman & CEO

Valkin Limited DBA OCEAN https://www.thisisocean.com https://www.linkedin.com/in/vishalhk/

PS: Please feel free to drop any time in my calendar here to catch up.

Pingback: order androxal generic available in united states

Pingback: comprar rifaximin generica

Pingback: discount avodart generic south africa

Pingback: discount flexeril cyclobenzaprine australia suppliers

Pingback: get gabapentin generic canada no prescription

Pingback: purchase itraconazole australia generic online

Pingback: kamagra pas cher à vendre sans prescription requise